Question: Question 2 (Marks: 45) Read the following case study and then answer the questions that follow. Based in Cleveland, Ohio, DeepGreen Financial (which was acquired

Question 2 (Marks: 45) Read the following case study and then answer the questions that follow. Based in Cleveland, Ohio, DeepGreen Financial (which was acquired in March 2004 by Lightyear Capital, a New Yorkbased private equity investment firm) has revolutionized the mortgage industry by providing lowrate, home equity products that are easy to apply for and obtain over the Internet. DeepGreen even offers to close the loan at the borrowers home. DeepGreens efficient and innovative technology has reduced the cost of loan production, which they pass on to the consumer. An Internetonly home equity lender, DeepGreen originates loans in 47 states and makes them available through its Web site and through partners such as LendingTree, LLC, Priceline, and Costco Wholesale Corporation. DeepGreen originates home equity products at five times the industry average in terms of dollars per employee. Right from its start in August 2000, DeepGreen has been based on efficient knowledge utilization. Right from the firms creation, the vision for it was to rely on automated decision technology. DeepGreen created an Internetbased system that makes credit decisions within minutes by selecting the customers with the best credit. Efficient knowledge utilization through routines embedded as rules within an automated system, along with efficient use of online information, enabled only eight employees to process about 400 applications daily. Instead of competing on the basis of interest rates, DeepGreen competed in terms of ease of application (a customer could complete the application within five minutes) and by providing nearly instantaneous, unconditional decisions without requiring the borrowers to provide the usual appraisals or paperwork upfront. This quick decision is enabled through knowledge application and the computation of credit score and property valuation using online data. In about 80 percent of the cases, a final decision is provided to the customer within two minutes of the application being completed. Online Banking Report named DeepGreens home equity lines of credit as the Best of the Web.

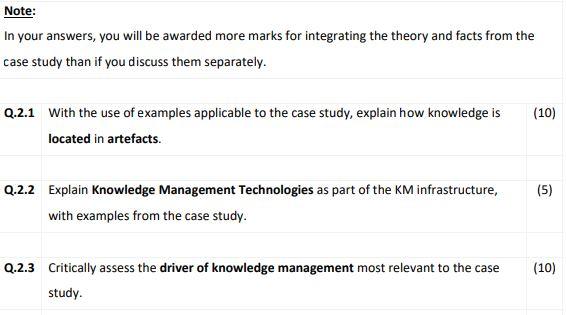

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts