Question: Today is April 7, 2025, and you about to enter into forward rate agreements with clients who wish to unwind their interest rate risk

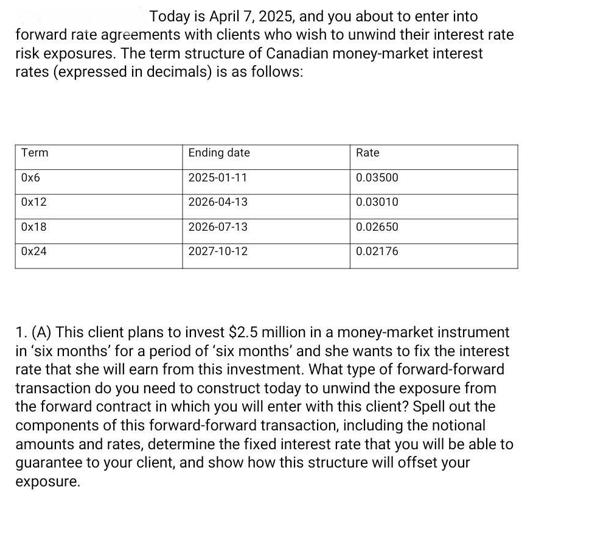

Today is April 7, 2025, and you about to enter into forward rate agreements with clients who wish to unwind their interest rate risk exposures. The term structure of Canadian money-market interest rates (expressed in decimals) is as follows: Term Ending date Rate 0x6 2025-01-11 0.03500 Ox12 2026-04-13 0.03010 Ox18 2026-07-13 0.02650 Ox24 2027-10-12 0.02176 1. (A) This client plans to invest $2.5 million in a money-market instrument in 'six months' for a period of 'six months' and she wants to fix the interest rate that she will earn from this investment. What type of forward-forward transaction do you need to construct today to unwind the exposure from the forward contract in which you will enter with this client? Spell out the components of this forward-forward transaction, including the notional amounts and rates, determine the fixed interest rate that you will be able to guarantee to your client, and show how this structure will offset your exposure.

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Since the client is planning to invest 25 million in six months for a period of 6 months which in... View full answer

Get step-by-step solutions from verified subject matter experts