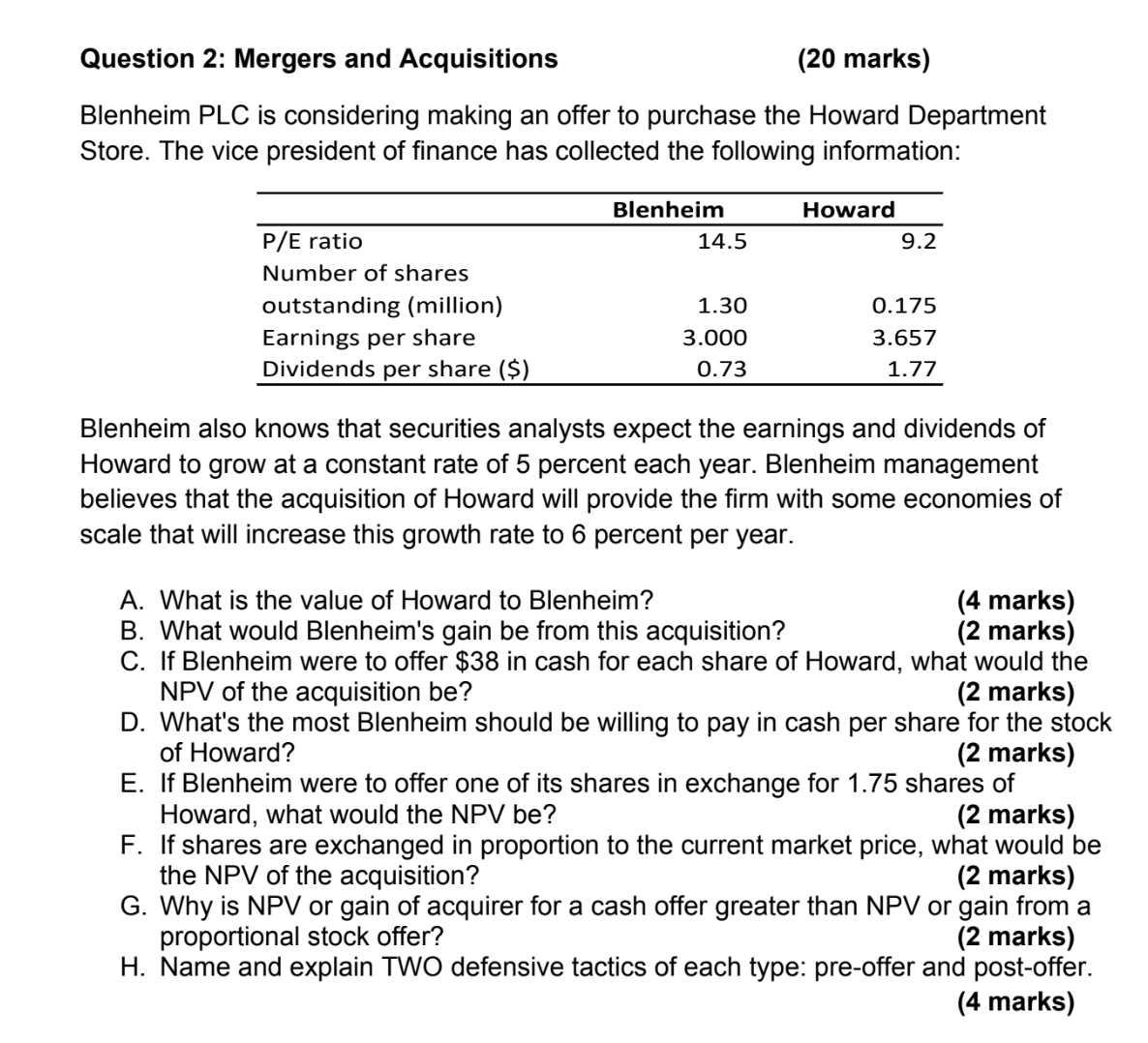

Question: Question 2 : Mergers and Acquisitions ( 2 0 marks ) Blenheim PLC is considering making an offer to purchase the Howard Department Store. The

Question : Mergers and Acquisitions marks Blenheim PLC is considering making an offer to purchase the Howard Department Store. The vice president of finance has collected the following information: Blenheim also knows that securities analysts expect the earnings and dividends of Howard to grow at a constant rate of percent each year. Blenheim management believes that the acquisition of Howard will provide the firm with some economies of scale that will increase this growth rate to percent per year. A What is the value of Howard to Blenheim? B What would Blenheim's gain be from this acquisition? C If Blenheim were to offer $ in cash for each share of Howard, what would the NPV of the acquisition be D What's the most Blenheim should be willing to pay in cash per share for the stock of Howard? E If Blenheim were to offer one of its shares in exchange for shares of Howard, what would the NPV be marks F If shares are exchanged in proportion to the current market price, what would be the NPV of the acquisition? G Why is NPV or gain of acquirer for a cash offer greater than NPV or gain from a proportional stock offer? H Name and explain TWO defensive tactics of each type: preoffer and postoffer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock