Question: QUESTION 2: Micromanaged Widgets (MW) is planning to set up a new factory in London. The new plant will require an initial investment in plant,

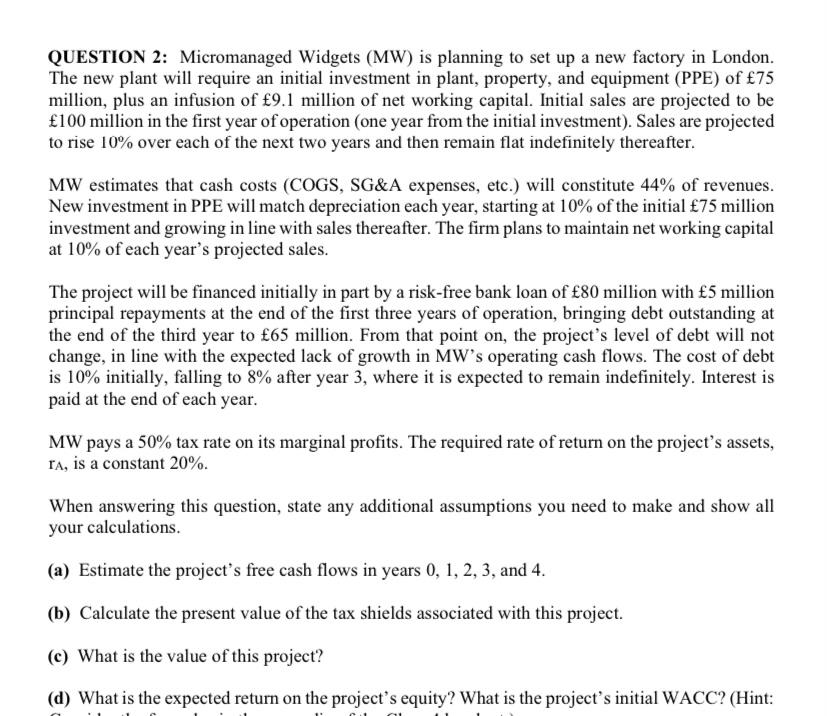

QUESTION 2: Micromanaged Widgets (MW) is planning to set up a new factory in London. The new plant will require an initial investment in plant, property, and equipment (PPE) of 75 million, plus an infusion of 9.1 million of net working capital. Initial sales are projected to be 100 million in the first year of operation (one year from the initial investment). Sales are projected to rise 10% over each of the next two years and then remain flat indefinitely thereafter. MW estimates that cash costs (COGS, SG&A expenses, etc.) will constitute 44% of revenues. New investment in PPE will match depreciation each year, starting at 10% of the initial 75 million investment and growing in line with sales thereafter. The firm plans to maintain net working capital at 10% of each year's projected sales. The project will be financed initially in part by a risk-free bank loan of 80 million with 5 million principal repayments at the end of the first three years of operation, bringing debt outstanding at the end of the third year to 65 million. From that point on, the project's level of debt will not change, in line with the expected lack of growth in MW's operating cash flows. The cost of debt is 10% initially, falling to 8% after year 3, where it is expected to remain indefinitely. Interest is paid at the end of each year. MW pays a 50% tax rate on its marginal profits. The required rate of return on the project's assets, ra, is a constant 20%. When answering this question, state any additional assumptions you need to make and show all your calculations. (a) Estimate the project's free cash flows in years 0, 1, 2, 3, and 4. (b) Calculate the present value of the tax shields associated with this project. (e) What is the value of this project? (d) What is the expected return on the project's equity? What is the project's initial WACC? (Hint: QUESTION 2: Micromanaged Widgets (MW) is planning to set up a new factory in London. The new plant will require an initial investment in plant, property, and equipment (PPE) of 75 million, plus an infusion of 9.1 million of net working capital. Initial sales are projected to be 100 million in the first year of operation (one year from the initial investment). Sales are projected to rise 10% over each of the next two years and then remain flat indefinitely thereafter. MW estimates that cash costs (COGS, SG&A expenses, etc.) will constitute 44% of revenues. New investment in PPE will match depreciation each year, starting at 10% of the initial 75 million investment and growing in line with sales thereafter. The firm plans to maintain net working capital at 10% of each year's projected sales. The project will be financed initially in part by a risk-free bank loan of 80 million with 5 million principal repayments at the end of the first three years of operation, bringing debt outstanding at the end of the third year to 65 million. From that point on, the project's level of debt will not change, in line with the expected lack of growth in MW's operating cash flows. The cost of debt is 10% initially, falling to 8% after year 3, where it is expected to remain indefinitely. Interest is paid at the end of each year. MW pays a 50% tax rate on its marginal profits. The required rate of return on the project's assets, ra, is a constant 20%. When answering this question, state any additional assumptions you need to make and show all your calculations. (a) Estimate the project's free cash flows in years 0, 1, 2, 3, and 4. (b) Calculate the present value of the tax shields associated with this project. (e) What is the value of this project? (d) What is the expected return on the project's equity? What is the project's initial WACC? (Hint

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts