Question: Question 2 (M&M, Case II, Proposition II) Allocated Mark = 8 marks Bahrain Hotels Company B.S.C. has an expected EBIT of $ 17 million in

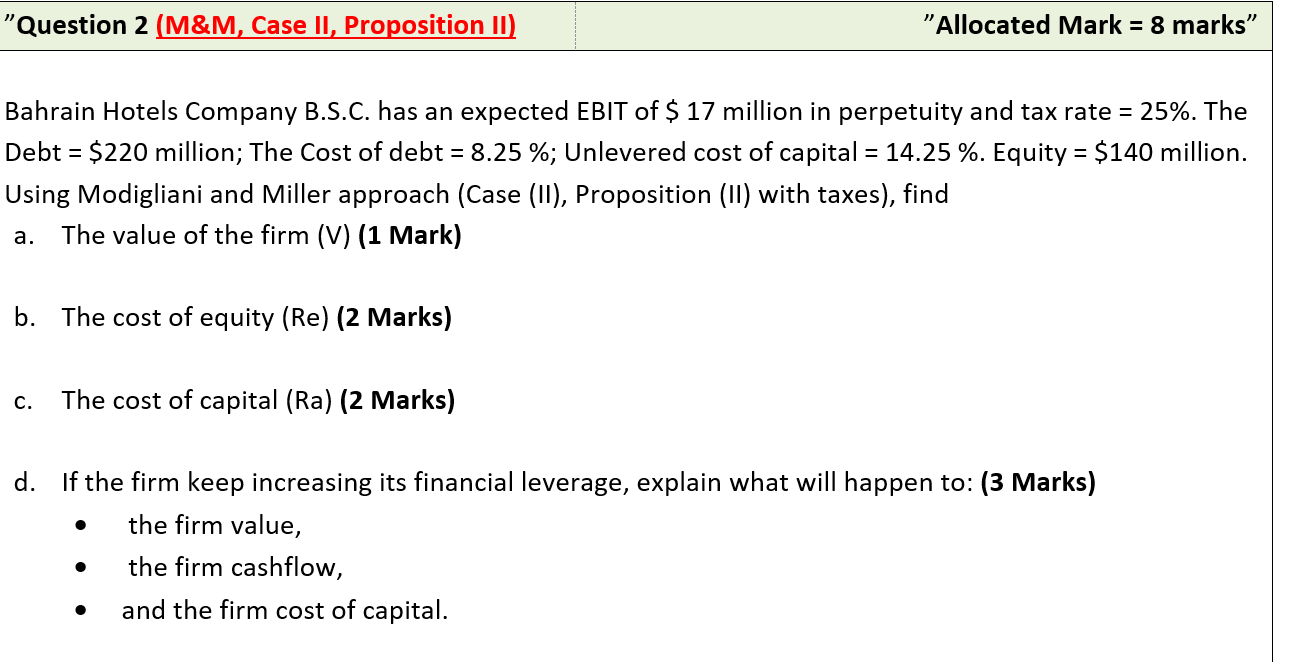

"Question 2 (M&M, Case II, Proposition II) "Allocated Mark = 8 marks Bahrain Hotels Company B.S.C. has an expected EBIT of $ 17 million in perpetuity and tax rate = 25%. The Debt = $220 million; The Cost of debt = 8.25 %; Unlevered cost of capital = 14.25 %. Equity = $140 million. Using Modigliani and Miller approach (Case (11), Proposition (11) with taxes), find The value of the firm (V) (1 Mark) a. b. The cost of equity (Re) (2 Marks) c. The cost of capital (Ra) (2 Marks) d. If the firm keep increasing its financial leverage, explain what will happen to: (3 Marks) the firm value, the firm cashflow, and the firm cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts