Question 2: (Modern Bank Runs) Consider a simple bank that has assets of 100, capital of...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

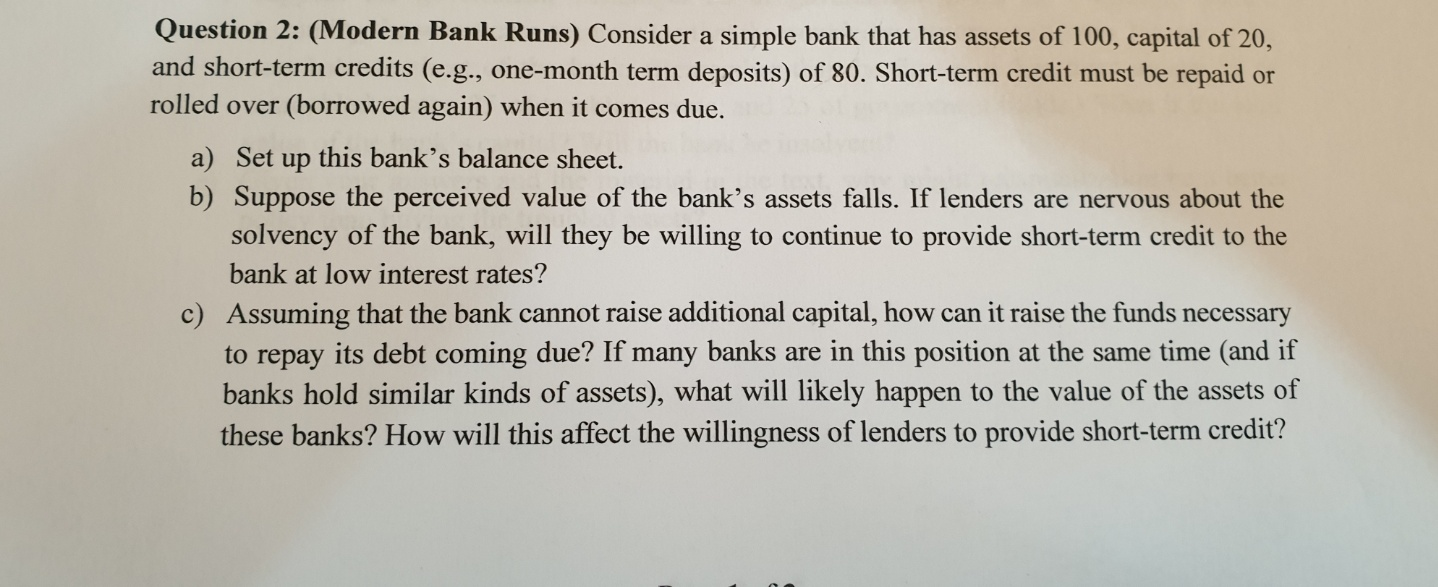

Question 2: (Modern Bank Runs) Consider a simple bank that has assets of 100, capital of 20, and short-term credits (e.g., one-month term deposits) of 80. Short-term credit must be repaid or rolled over (borrowed again) when it comes due. a) Set up this bank's balance sheet. b) Suppose the perceived value of the bank's assets falls. If lenders are nervous about the solvency of the bank, will they be willing to continue to provide short-term credit to the bank at low interest rates? c) Assuming that the bank cannot raise additional capital, how can it raise the funds necessary to repay its debt coming due? If many banks are in this position at the same time (and if banks hold similar kinds of assets), what will likely happen to the value of the assets of these banks? How will this affect the willingness of lenders to provide short-term credit? Question 2: (Modern Bank Runs) Consider a simple bank that has assets of 100, capital of 20, and short-term credits (e.g., one-month term deposits) of 80. Short-term credit must be repaid or rolled over (borrowed again) when it comes due. a) Set up this bank's balance sheet. b) Suppose the perceived value of the bank's assets falls. If lenders are nervous about the solvency of the bank, will they be willing to continue to provide short-term credit to the bank at low interest rates? c) Assuming that the bank cannot raise additional capital, how can it raise the funds necessary to repay its debt coming due? If many banks are in this position at the same time (and if banks hold similar kinds of assets), what will likely happen to the value of the assets of these banks? How will this affect the willingness of lenders to provide short-term credit?

Expert Answer:

Answer rating: 100% (QA)

Banks are the important macroeconomic indicators of a country Explanation a Banks balance ... View the full answer

Related Book For

Posted Date:

Students also viewed these economics questions

-

Consider a simple economy that produces two goods, beer (denoted by x) and quiche (denoted by y), using labor and capital (denoted by L and K, respectively) that are supplied by two types of...

-

Consider a simple firm that has the following market-value balance sheet: Next year, there are two possible values for its assets, each equally likely: $1200 and $960. Its debt will be due with 5%...

-

Consider a simple economy that produces only three products: haircuts, hamburgers, and Blu-rays. Use the information in the following table to calculate the inflation rate for 2016, as measured by...

-

Ruff, Tuff, and Duff are parners sharing profits and losses 30/30/40 respectively. Their balance sheet is below: Cash Receivable from Ruff Property & Equipment $200,000 10,000 500,000 $710,000...

-

Elaine died on May 1, 2016. Her gross estate consisted of the following items: Cash .................................................................. $ 40,000 Stocks traded on a stock exchange...

-

As the new Director of HR with Wilson Bros, you have been given approval to hire the following- Two Administrative Assistants that will report to you both working from the Toronto office location....

-

Identify the most appropriate approach and then design. Provide a rationale as to why this approach and design would be most appropriate. Develop a hypothetical research scenario that would...

-

Bjerg Company specializes in manufacturing a unique model of bicycle helmet. The model is well accepted by consumers, and the company has enough orders to keep the factory production at 10,000...

-

In Milestone Two, you will review the Final Project Client Information document to identify all beneficiaries and discuss potential tax ramifications of receiving inherited property. In addition, you...

-

Hill has two options to enter the small business market through a partnership or through direct sales. The costs and pricing differ for each approach. Hill Partnership: Sales price is 35% lower Hill...

-

Solomon describes the view that business and ethics dont mix as the myth of amoral business why does he think it is a myth? Do you agree?

-

What is time management? What is diversity? Define sexual harassment. Describe the primary issue in oil production today. List five significant events in the history and development of the chemical...

-

How can we explain these in relation to research? Related Literature Review of Related Literature Traditional review of literature Systematic review of literature

-

Identify some ways global advertising campaigns benefit a company. How can we ensure these campaigns are net benefits? (Think cultural considerations.)

-

Is a literature review the same as a thematic literature review? What is the difference between thematic and chronological literature review?

-

Assuming a wealthy couple had a simple 100% marital deduction plan when S1 died, explain how each of the following defers or reduce the estate tax for S2: (a) remarriage; (b) consumption; or (c)...

-

Answer number 1 - Calculate the following ratios for Pebblebrook (round all amounts to one decimal place). Show your work in the space provided, including the amounts you used in the formula (both...

-

How has the too-big-to-fail policy been limited in the FDICIA legislation? How might limiting the too-big-to-fail policy help reduce the risk of a future banking crisis?

-

Scott consumes only two goods, steak and ale. When the price of steak falls, he buys more steak and more ale. On an optimal choice diagram (with budget lines and indifference curves), illustrate this...

-

Figure 10.18 below shows the supply and demand curves for cigarettes. The equilibrium price in the market is $2 per pack if the government does not intervene, and the quantity exchanged in the market...

-

As shown in the following figure, a consumer buys two goods, food and housing, and likes both goods. When she has budget line BL1, her optimal choice is basket A. Given budget line BL2, she chooses...

-

Role of controller, role of chief financial officer. George Jimenez is the controller at Balkin Electronics, a manufacturer of devices for the computer industry. The company may promote him to chief...

-

In the following, assume that all growth and discount rates are stated in real terms. 1. Assume the Eurozone inflation-adjusted average growth in capital stock is 3.0 percent per annum into...

-

Which conclusion presented by Ryan about the top-down approach and the bottom-up approach is most likely correct? A. Conclusion 1. B. Conclusion 2. C. Conclusion 3. Use the following information to...

Study smarter with the SolutionInn App