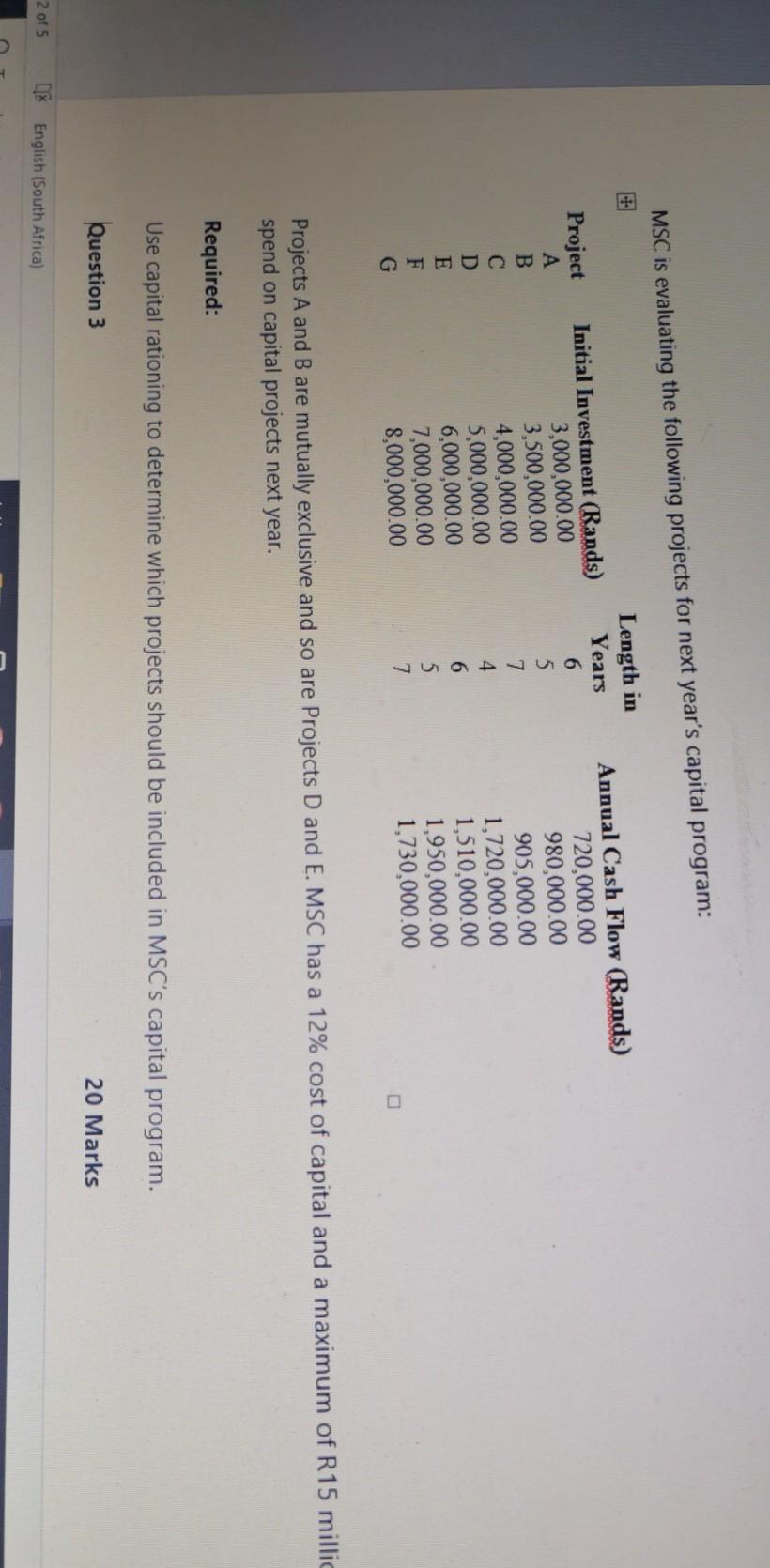

Question: Question 2 MSC is evaluating the following projects for next year's capital program: Project A D E F G Initial Investment (Rands) 3,000,000.00 3,500,000.00 4,000,000.00

Question 2

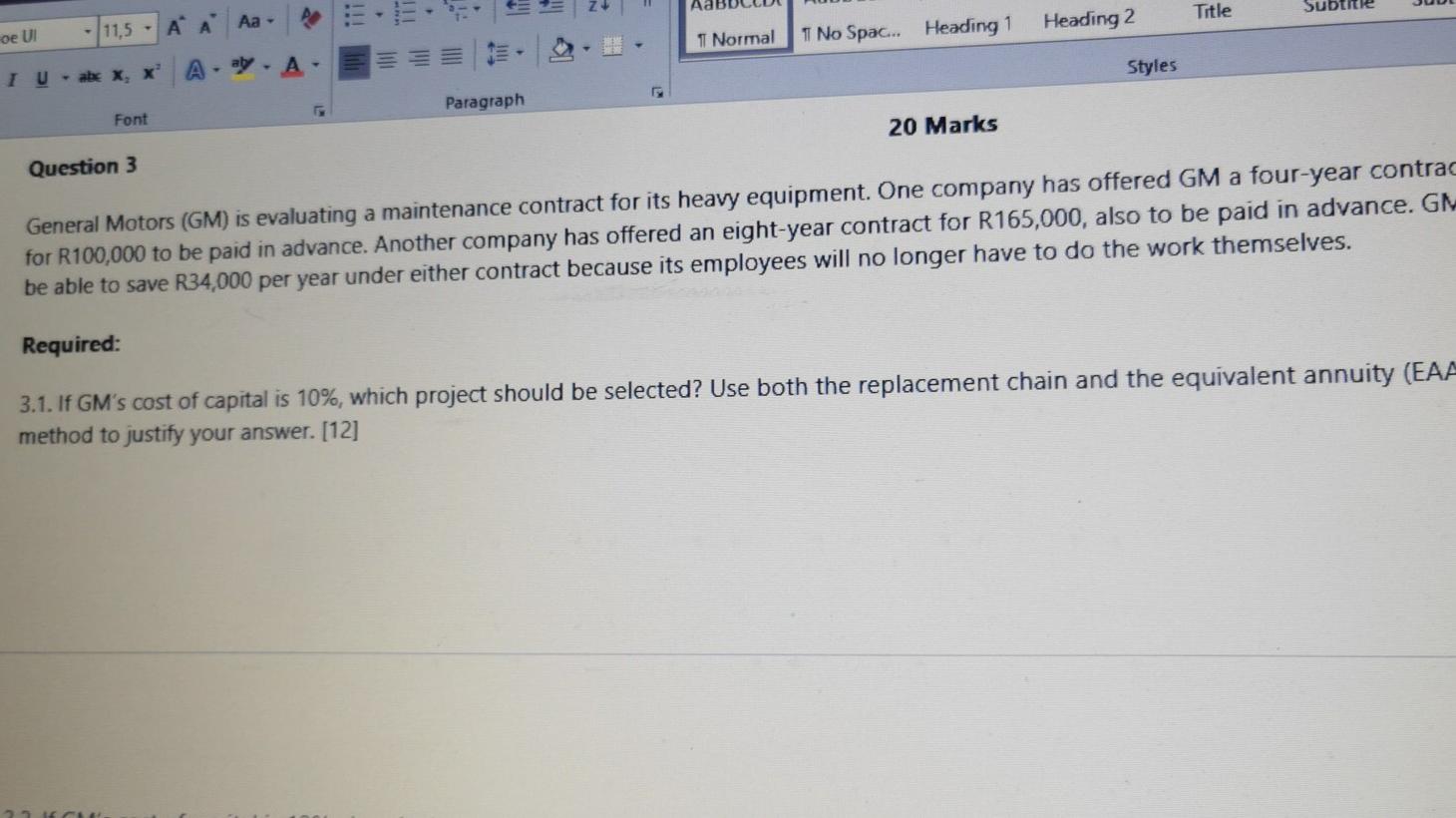

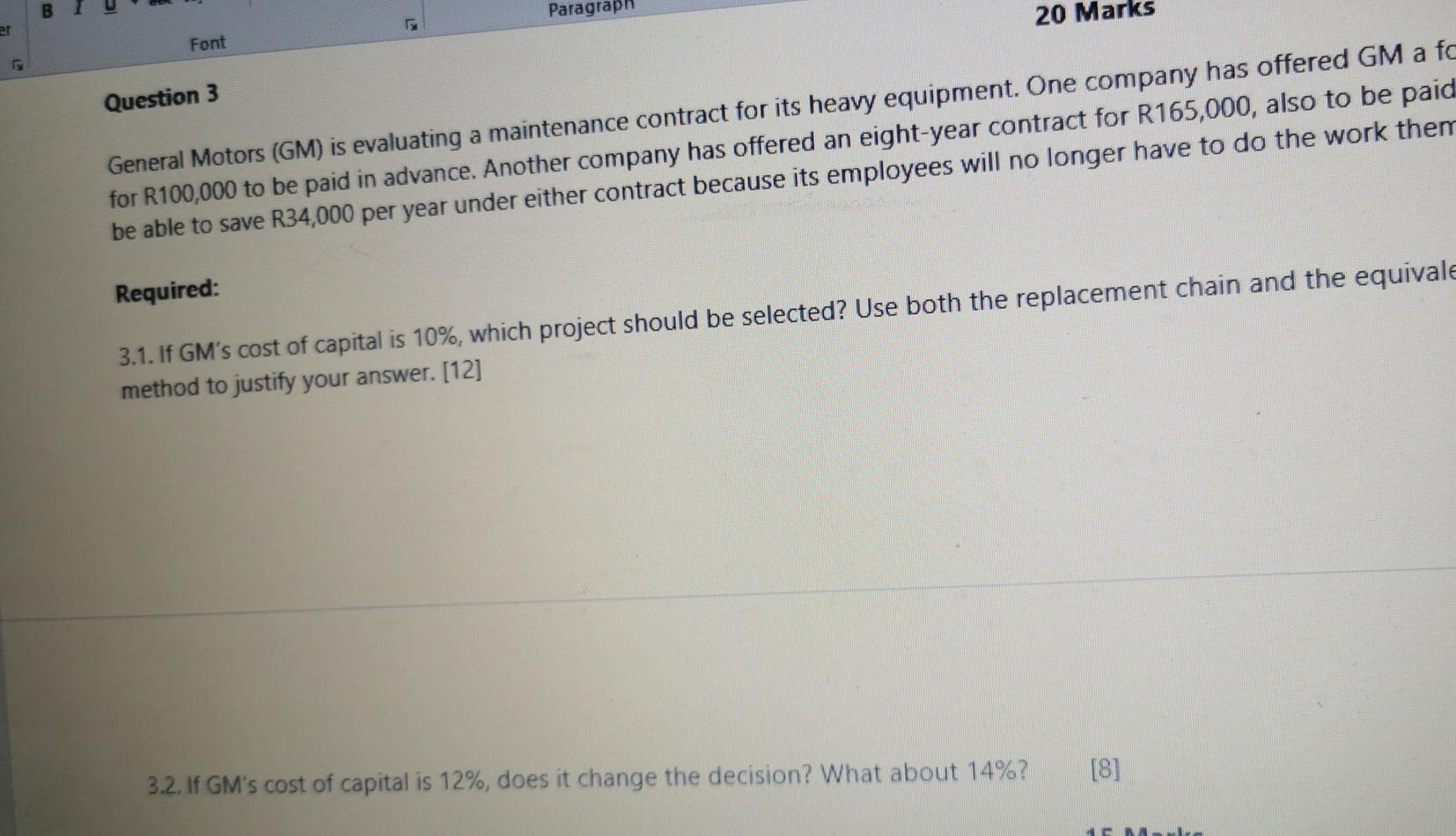

MSC is evaluating the following projects for next year's capital program: Project A D E F G Initial Investment (Rands) 3,000,000.00 3,500,000.00 4,000,000.00 5,000,000.00 6,000,000.00 7,000,000.00 8,000,000.00 Length in Years 6 5. 7 4 6 5 7 Annual Cash Flow (Rands) 720,000.00 980,000.00 905,000.00 1,720,000.00 1,510,000.00 1,950,000.00 1,730,000.00 Projects A and B are mutually exclusive and so are Projects D and E. MSC has a 12% cost of capital and a maximum of R15 millic spend on capital projects next year. Required: Use capital rationing to determine which projects should be included in MSC's capital program. Question 3 20 Marks 2 of 5 [ English (South Africa) Title Subtitle 11,5 - A A Aa - Heading 2 oe UI Normal TT No Spac... Heading 1 . A - ab Styles IU - abe X, X Paragraph Font 20 Marks Question 3 General Motors (GM) is evaluating a maintenance contract for its heavy equipment. One company has offered GM a four-year contrac for R100,000 to be paid in advance. Another company has offered an eight-year contract for R165,000, also to be paid in advance. GM be able to save R34,000 per year under either contract because its employees will no longer have to do the work themselves. Required: 3.1. If GM's cost of capital is 10%, which project should be selected? Use both the replacement chain and the equivalent annuity (EAA method to justify your answer. [12] 21 Paragraph G 20 Marks er Font Question 3 General Motors (GM) is evaluating a maintenance contract for its heavy equipment. One company has offered GM a fo for R100,000 to be paid in advance. Another company has offered an eight-year contract for R165,000, also to be paid be able to save R34,000 per year under either contract because its employees will no longer have to do the work them Required: 3.1. If GM's cost of capital is 10%, which project should be selected? Use both the replacement chain and the equivale method to justify your answer. [12] [8] 3.2. If GM's cost of capital is 12%, does it change the decision? What about 14%? DA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts