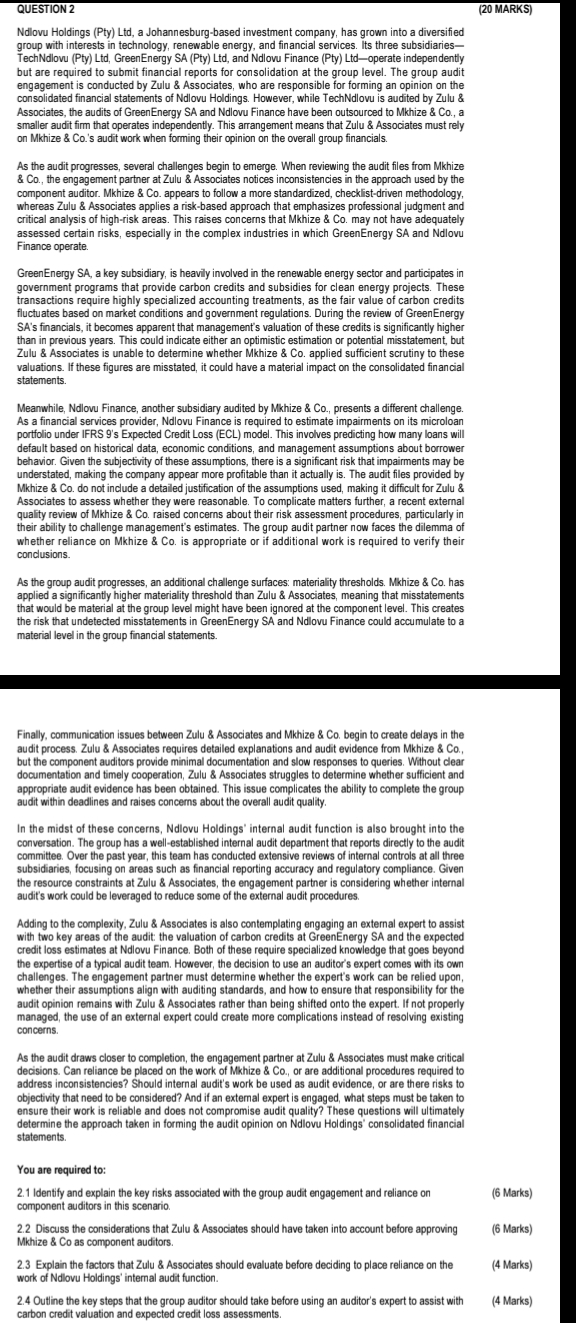

Question: QUESTION 2 Ndlovu Holdings ( Pty ) Ltd , a Johannesburg - based investment company, has grown into a diversifi edgroup with interests in technology,

QUESTION Ndlovu Holdings Pty Ltd a Johannesburgbased investment company, has grown into a diversifi edgroup with interests in technology, renewable energy, and financial services. Its three subsidiariesTechNdlovu Pty Ltd Green Energy SA Pty Ltd and Ndlovu Finance Pty Ltdoperate indepen dentlybut are required to submit financial reports for consolidation at the group level. The group auditengagement is conducted by Zulu & Associates, who are responsible for forming an opinion on thesmaller audit firn that operates independently. This arrangement means that Zulu & Associates must relyon Mkhize & Cos audit work when forming their opinion on the overall group financials.As the audit progresses, several challenges begin to emerge. When reviewing the audit files from Mkhize& Co the engagement partner at Zulu & Associates notices inconsistencies in the approach used by theauuditewhereas ulZulu & Associates applies a riskbased approach that emphasizes professional judg ment andcritical analysis of highrisk areas. This raises concerns that Mkhize & Co may not have adequatelyGreenEnerqy SA a key subsidiar heavily involved in the wablegovernment programs that proide carbon credits and subsidies for clean eneroy proiects Thesetransactions require highly specialized accounting treatments, as the fair value of carbon creditsfluctu ates based on market conditions and government regulations. During the review of GreenEnergySA's financials, it becomes apparent that management's valuation of these credits is significantly higherthan in previous years. This could indicate either an opimistic estimation or potential misstatement, butwaluatinns these finures are misstated it coid hae a materal imnact on the cnnsoidated fnanstatementsMeanwhile, Ndlovu Finance, another subsidiary audited by Mkhize & Co presents a different challenge.As a financial services provider, Ndlovu Finance is required to estimate impairments on its microloanportiolio under lFRS s Expected Credit Loss ECL model. This involves predicing how many loans willconcusions.behavior. Given the subjecivity of these assumptions, there is a significant risk that impairments may beunderstated, making the company appear more profitable than it actually is The audit files provided byMkhize & Co do not incdude a detailed justification of the assumptions used, making it difficult for Zulu &Associates to assess whether they were reasonable. To complicate matters further, a recent externalquai y review or kze rased Concems abouer nsk essessment proceoures, paculany inwhether relian ce on Mkhize & Co is appropriate or if additional work is required to verify theirAs the group audit progresses, an additional challenge surfaces: materiality thresholds. Mkhize & Co hasapplied a signtficanty higher materiality threshold than Zulu & Associates, meaning that misstatementsthe risk that undetected misstatements in GreenEnergy SA and Ndlovu Finance could accumulate to amaterial level in the group financial statements.articioFinally, communication issues between Zulu & Associates and Mkhize & Co begin to create delays in theaudit process Zulu & Associates requires detailed explanations and audit evidence from Mkhize & Cobut the component auditors provide minimal documentation and slow responses to queries. Without deardocumentation and timely cooperation, Zulu & Associates struggles to determine whether sufficient andappropriate audit evidence has been obtained. This issue complicates the ability to complete the groupaudit within deadlines and raises concens about the overall audit quality.In the midst of these concerns, Ndlovu Holdings' internal audit function is also brought into theconversation. The group has a well.established internal audit department that reports directly to the auditcommittee. Over the past year, this team has conducted extensive reviews of internal controls at all threesubsidiaries, focusing on areas such as financial reporting accuracy and regulatory compliance. Giventhe resource constraints at Zulu & Associates, the engagement partner is considering whether internalaudit's work could be leveraged to reduce some of the exti audit procedures.Adding to the complexity, Zulu & Associates is also contemplating engaging an external expert to assistwith two key areas of the audit the valuation of carbon credits at GreenEnergy SA and the expectedcredit loss estimates at Ndlovu Finance. Both of these require specialized knowledge that goes beyondthe expertise of a typical audit team. However, the decision to use an auditor's expert comes with its oWrconcerns.whether their assumptons align with auditing standards, and how to ensure that responsibility for theaudit opinion remains with Zulu & Associates rather than being shifted onto the expert. If not properlymanaged, the use of an external expert could create more complications instead of resolving existingAs the audit draws closerat Zulu & AssodYou are required to:ke criticaldecisi

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock