Question: Question 2 Not yet answered DA Time left 1:26:45 Answer: Marked out of 15.00 Flag question Consider a stock XYZ pays a continuous dividends

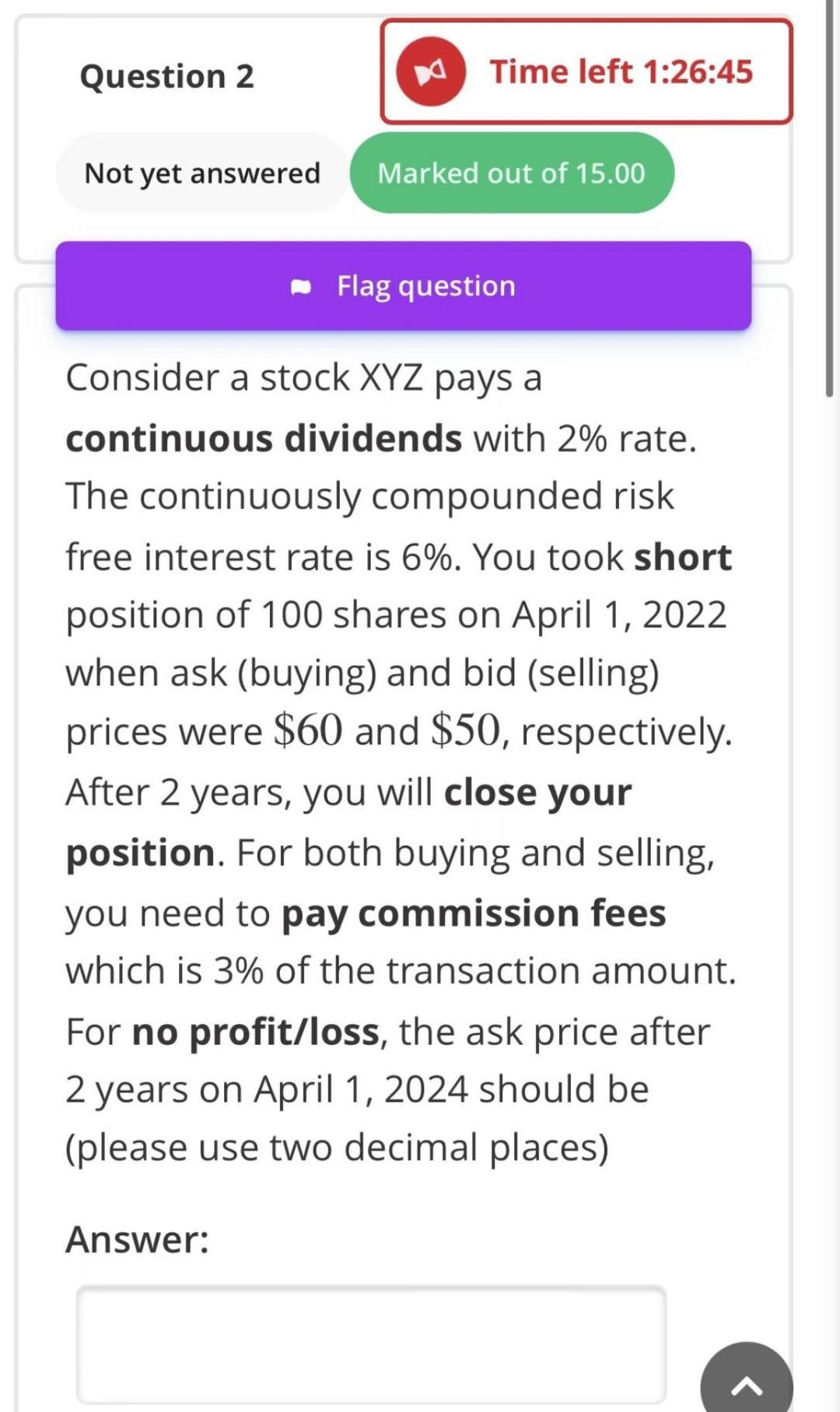

Question 2 Not yet answered DA Time left 1:26:45 Answer: Marked out of 15.00 Flag question Consider a stock XYZ pays a continuous dividends with 2% rate. The continuously compounded risk free interest rate is 6%. You took short position of 100 shares on April 1, 2022 when ask (buying) and bid (selling) prices were $60 and $50, respectively. After 2 years, you will close your position. For both buying and selling, you need to pay commission fees which is 3% of the transaction amount. For no profit/loss, the ask price after 2 years on April 1, 2024 should be (please use two decimal places)

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Answer The future value of the shares with no profit loss ie no arbitrage price ... View full answer

Get step-by-step solutions from verified subject matter experts