Question: Question 2 of 1 0 - / 1 Current Attempt in Progress In its first year of operations, Sandhill Co . recognized $ 3 4

Question of

Current Attempt in Progress

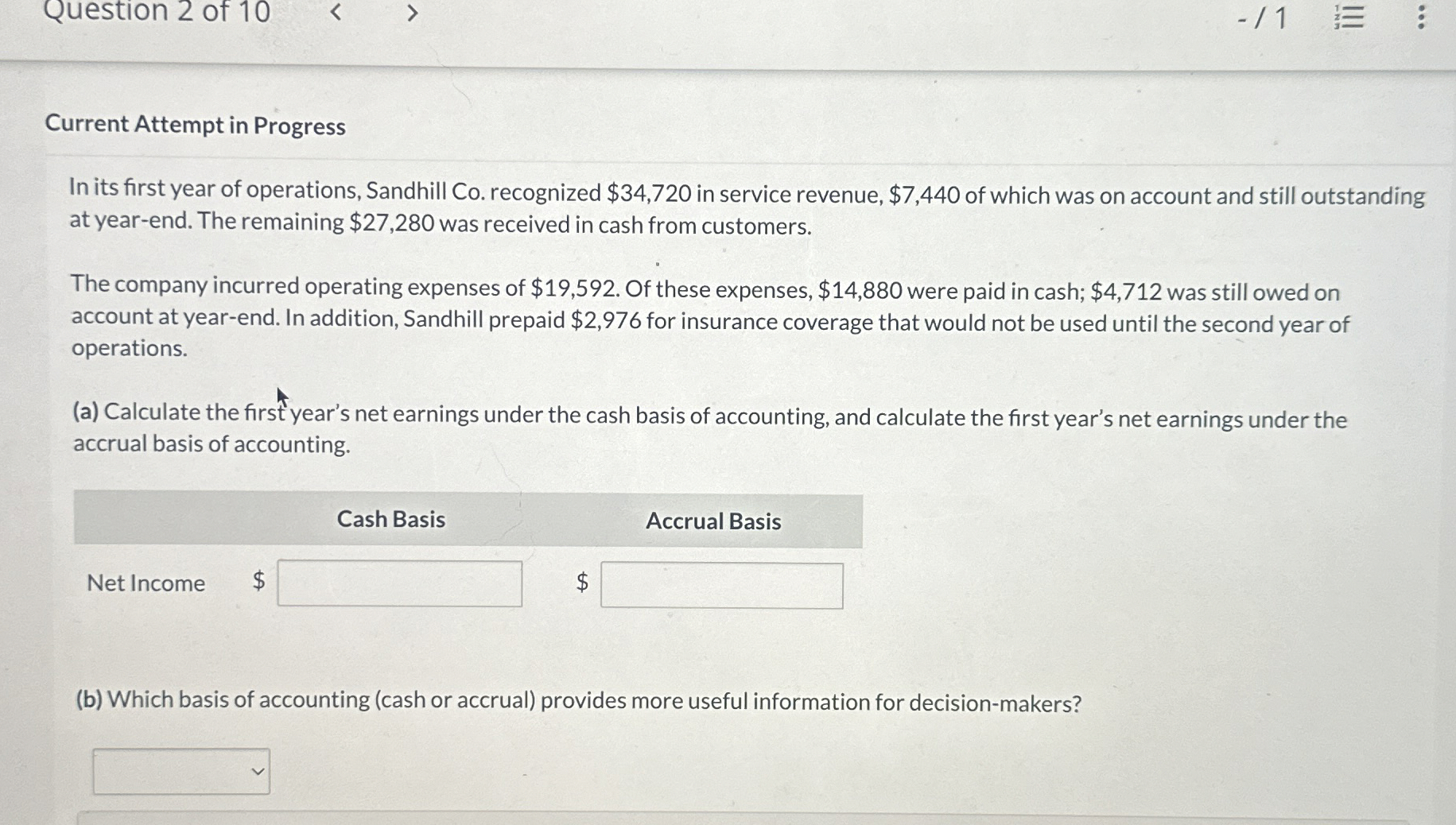

In its first year of operations, Sandhill Co recognized $ in service revenue, $ of which was on account and still outstanding at yearend. The remaining $ was received in cash from customers.

The company incurred operating expenses of $ Of these expenses, $ were paid in cash; $ was still owed on account at yearend. In addition, Sandhill prepaid $ for insurance coverage that would not be used until the second year of operations.

a Calculate the first year's net earnings under the cash basis of accounting, and calculate the first year's net earnings under the accrual basis of accounting.

tableCash Basis,Accrual BasisNet Income $$

b Which basis of accounting cash or accrual provides more useful information for decisionmakers?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock