Question: Question 2 of 3 Help with solution 8 . 8 9 2 0 Current Attempt in Progress Your answer is partially correct. Inexperienced construction company

Question of

Help with solution

Current Attempt in Progress

Your answer is partially correct.

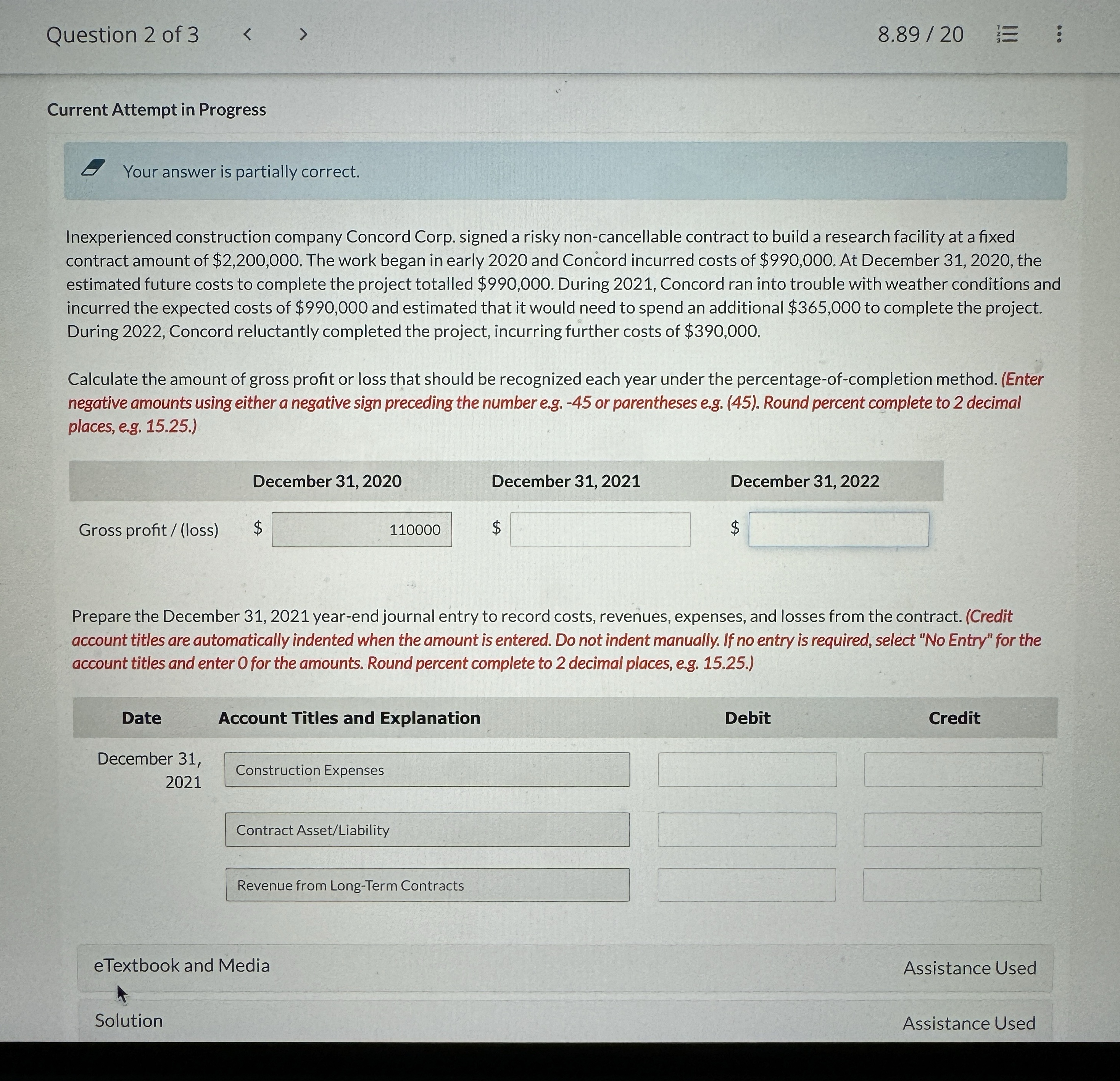

Inexperienced construction company Concord Corp. signed a risky noncancellable contract to build a research facility at a fixed contract amount of $ The work began in early and Concord incurred costs of $ At December the estimated future costs to complete the project totalled $ During Concord ran into trouble with weather conditions and incurred the expected costs of $ and estimated that it would need to spend an additional $ to complete the project. During Concord reluctantly completed the project, incurring further costs of $

Calculate the amount of gross profit or loss that should be recognized each year under the percentageofcompletion method. Enter negative amounts using either a negative sign preceding the number eg or parentheses eg Round percent complete to decimal places, eg

tableDecember December December Gross profit loss$$$

Prepare the December yearend journal entry to record costs, revenues, expenses, and losses from the contract. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. Round percent complete to decimal places, eg

Date

December

Construction Expenses

Contract AssetLiability

Revenue from LongTerm Contracts

Account Titles and Explanation

Debit

Credit

eTextbook and Media

Assistance Used

Solution

Assistance UsedQuestion of

Current Attempt in Progress

Your answer is partially correct.

Inexperienced construction company Concord Corp. signed a risky noncancellable contract to build a research facility at a fixed contract amount of $ The work began in early and Concord incurred costs of $ At December the estimated future costs to complete the project totalled $ During Concord ran into trouble with weather conditions and incurred the expected costs of $ and estimated that it would need to spend an additional $ to complete the project. During Concord reluctantly completed the project, incurring further costs of $

Calculate the amount of gross profit or loss that should be recognized each year under the percentageofcompletion method. Enter negative amounts using either a negative sign preceding the number eg or parentheses eg Round percent complete to decimal places, eg

tableDecember December December Gross profitloss$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock