Question: ( Question 2 ) On 1 6 . 5 . 2 0 1 3 , En Jamal purchased land for RM 8 0 0 ,

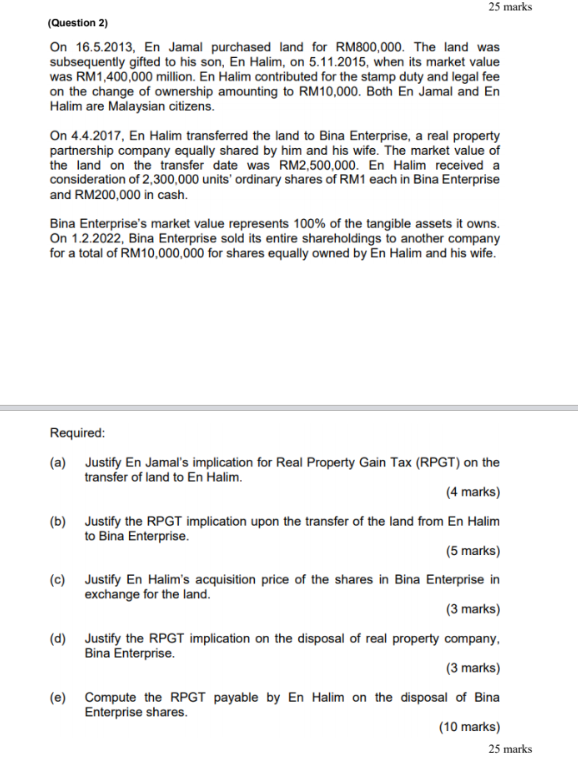

Question On En Jamal purchased land for RM The land was subsequently gifted to his son, En Halim, on when its market value was RM million. En Halim contributed for the stamp duty and legal fee on the change of ownership amounting to RM Both En Jamal and En Halim are Malaysian citizens. On En Halim transferred the land to Bina Enterprise, a real property partnership company equally shared by him and his wife. The market value of the land on the transfer date was RM En Halim received a consideration of units' ordinary shares of RM each in Bina Enterprise and RM in cash. Bina Enterprise's market value represents of the tangible assets it owns. On Bina Enterprise sold its entire shareholdings to another company for a total of RM for shares equally owned by En Halim and his wife. Required: a Justify En Jamal's implication for Real Property Gain Tax RPGT on the transfer of land to En Halim. b Justify the RPGT implication upon the transfer of the land from En Halim to Bina Enterprise. c Justify En Halim's acquisition price of the shares in Bina Enterprise in exchange for the land. d Justify the RPGT implication on the disposal of real property company, Bina Enterprise. e Compute the RPGT payable by En Halim on the disposal of Bina Enterprise shares.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock