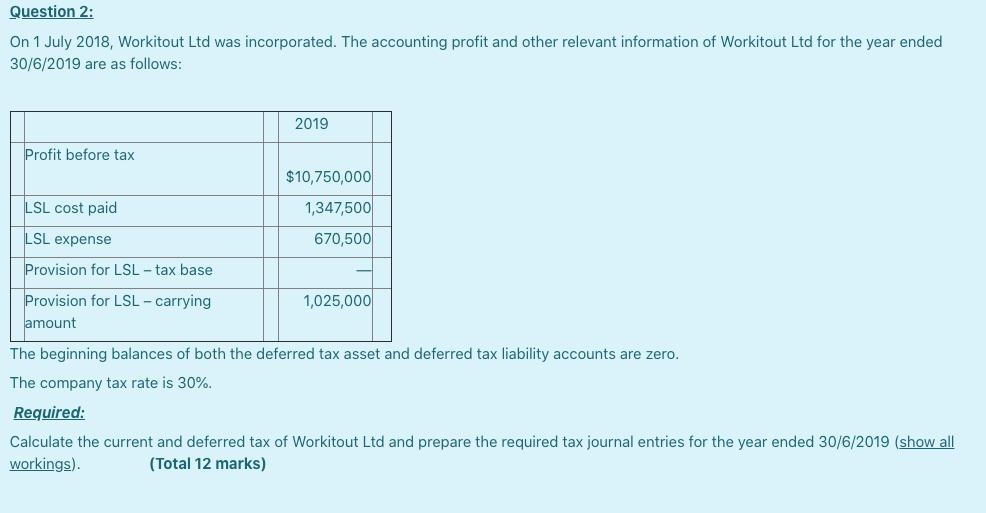

Question: Question 2: On 1 July 2018, Workitout Ltd was incorporated. The accounting profit and other relevant information of Workitout Ltd for the year ended 30/6/2019

Question 2: On 1 July 2018, Workitout Ltd was incorporated. The accounting profit and other relevant information of Workitout Ltd for the year ended 30/6/2019 are as follows: 2019 Profit before tax $10,750,000 1,347,500 LSL cost paid LSL expense 670,500 Provision for LSL - tax base Provision for LSL - carrying 1,025,000 amount The beginning balances of both the deferred tax asset and deferred tax liability accounts are zero. The company tax rate is 30%. Required: Calculate the current and deferred tax of Workitout Ltd and prepare the required tax journal entries for the year ended 30/6/2019 (show all workings). (Total 12 marks) Question 2: On 1 July 2018, Workitout Ltd was incorporated. The accounting profit and other relevant information of Workitout Ltd for the year ended 30/6/2019 are as follows: 2019 Profit before tax $10,750,000 1,347,500 LSL cost paid LSL expense 670,500 Provision for LSL - tax base Provision for LSL - carrying 1,025,000 amount The beginning balances of both the deferred tax asset and deferred tax liability accounts are zero. The company tax rate is 30%. Required: Calculate the current and deferred tax of Workitout Ltd and prepare the required tax journal entries for the year ended 30/6/2019 (show all workings). (Total 12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts