Question: Question 2 : On July 1 , 2 0 2 4 , Easton Company purchased for cash, twenty ( $ 1 0 ,

Question :

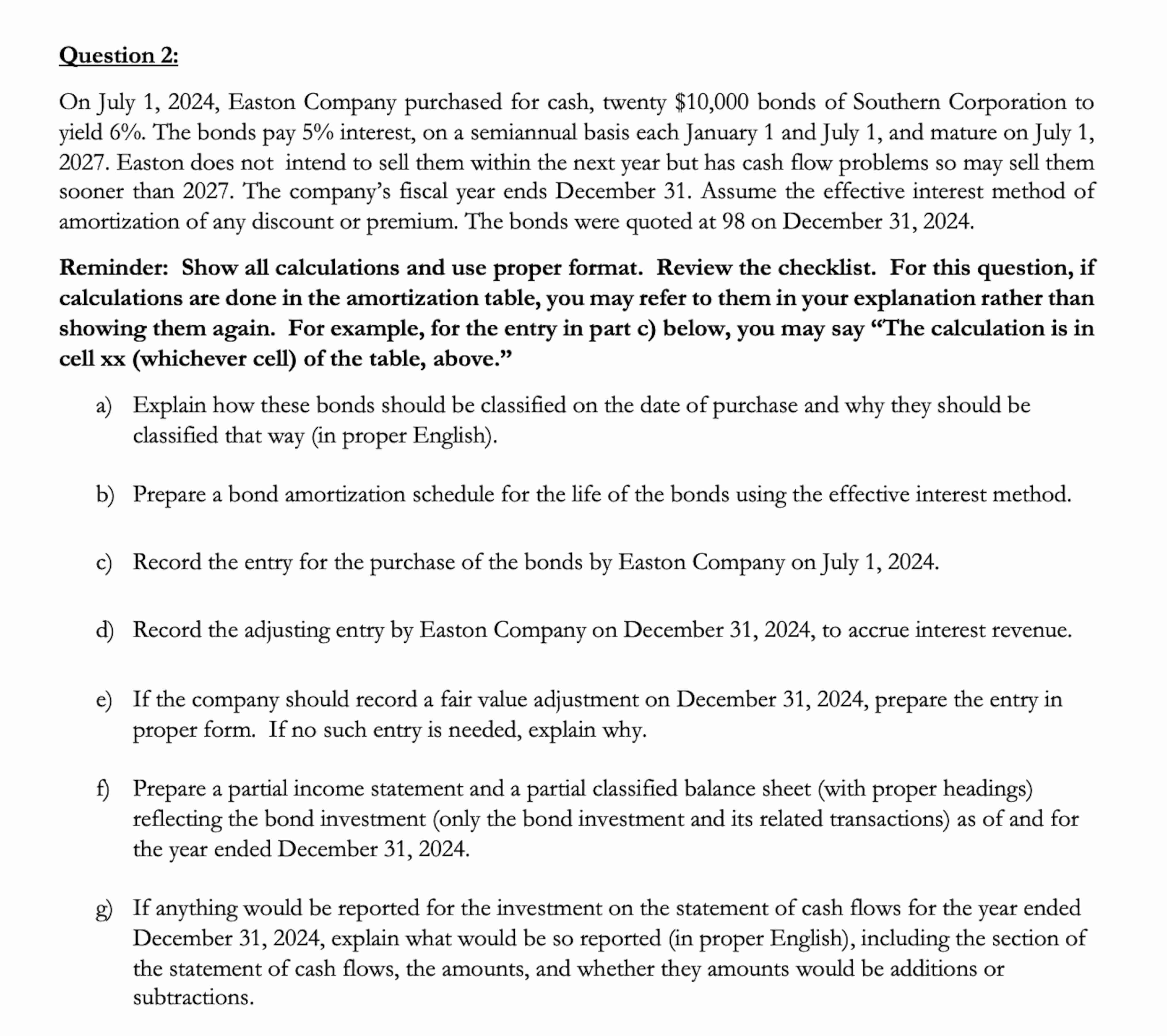

On July Easton Company purchased for cash, twenty $ bonds of Southern Corporation to yield The bonds pay interest, on a semiannual basis each January and July and mature on July Easton does not intend to sell them within the next year but has cash flow problems so may sell them sooner than The company's fiscal year ends December Assume the effective interest method of amortization of any discount or premium. The bonds were quoted at on December

Reminder: Show all calculations and use proper format. Review the checklist. For this question, if calculations are done in the amortization table, you may refer to them in your explanation rather than showing them again. For example, for the entry in part c below, you may say "The calculation is in cell x x whichever cell of the table, above."

a Explain how these bonds should be classified on the date of purchase and why they should be classified that way in proper English

b Prepare a bond amortization schedule for the life of the bonds using the effective interest method.

c Record the entry for the purchase of the bonds by Easton Company on July

d Record the adjusting entry by Easton Company on December to accrue interest revenue.

e If the company should record a fair value adjustment on December prepare the entry in proper form. If no such entry is needed, explain why.

f Prepare a partial income statement and a partial classified balance sheet with proper headings reflecting the bond investment only the bond investment and its related transactions as of and for the year ended December

g If anything would be reported for the investment on the statement of cash flows for the year ended December explain what would be so reported in proper English including the section of the statement of cash flows, the amounts, and whether they amounts would be additions or subtractions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock