Question: Question 2: On the day Trott Ltd redeemed its $1,000,000 face value bonds at 98, their carrying value was $1,200,000. Required: Prepare a residual analysis

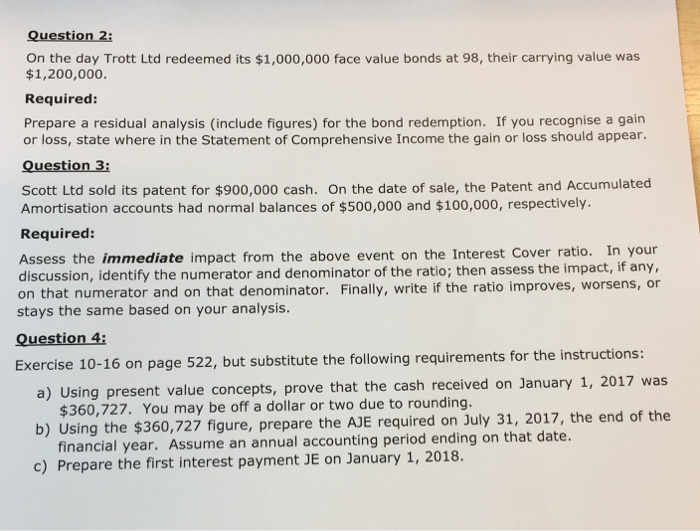

Question 2: On the day Trott Ltd redeemed its $1,000,000 face value bonds at 98, their carrying value was $1,200,000. Required: Prepare a residual analysis (include figures) for the bond redemption. If you recognise a gain or loss, state where in the Statement of Comprehensive Income the gain or loss should appear Question 3: Scott Ltd sold its patent for $900,000 cash. On the date of sale, the Patent and Accumulated Amortisation accounts had normal balances of $500,000 and $100,000, respectively. Required: Assess the immediate impact from the above event on the Interest Cover ratio. In your discussion, identify the numerator and denominator of the ratio; then assess the impact, if any on that numerator and on that denominator. Finally, write if the ratio improves, worsens, or stays the same based on your analysis. Question 4: Exercise 10-16 on page 522, but substitute the following requirements for the instructions: a) Using present value concepts, prove that the cash received on January 1, 2017 was $360,727. You may be off a dollar or two due to rounding. b) Using the $360,72 7 figure, prepare the AJE required on July 31, 2017, the end of the financial year. Assume an annual accounting period ending on that date. c) Prepare the first interest payment JE on January 1, 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts