Question: Question 2 only. B E H K L M N R LAB3: Multiple Plugs w Average Balance Method, Muti-y Take the assumptions as stated. Many

Question 2 only.

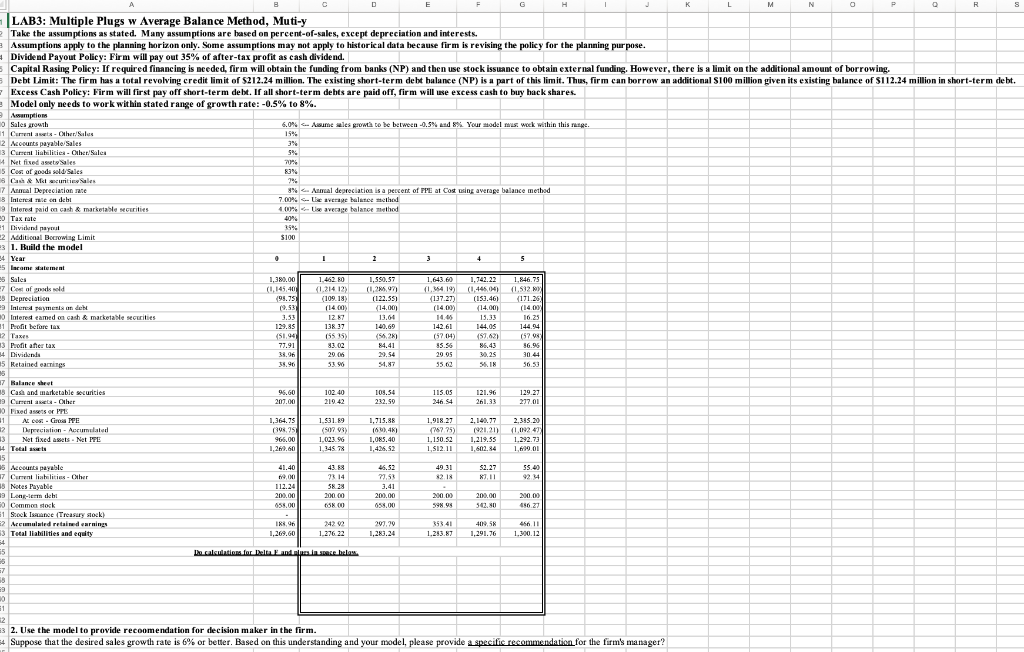

B E H K L M N R LAB3: Multiple Plugs w Average Balance Method, Muti-y Take the assumptions as stated. Many assumptions are based on percent-of-sales, except depreciation and interests. Assumptions apply to the planning horizon only. Some assumptions may not apply to historical data because firm is revising the policy for the planning purpose. Dividend Payout Policy: Firm will pay out 35% of after-tax profit as cash dividend. Capital Rasing Policy: If required financing is needed, firm will obtain the funding from banks (NP) and then use stock issuance to obtain external funding. However, there is a limit on the additional amount of borrowing, Debt Limit: The firm has a total revolving credit limit of $212.24 million. The existing short-term debt balance (NP) is a part of this limit. Thus, firm can borrow an additional S100 million given its existing balance of $112.24 million in short-term debt. Excess Cash Policy: Firm will first pay off short-term debt. If all short-term debts are paid off, firm will use excess cash to buy hack shares. Model only needs to work within stated range of growth rate: -0.5% to 8%. Amption o Sales rowth 6.0% Asume sales growth to be between -0.5% and 8%. Your model was week within this rese. 1 Current acts - Other Sales 15% 2 Accounts payable Sales 34 3 Current liabilities - Other Sales 5% 4 Net fixed at Sales 70% 5 Cost of goods sold, Sales 83% 18 Cash & Mauriti Sales 7 Amal Depreciation rate 8% Amal depreciation is a percent of PPE at Cost using average balance method 13 Intereale en de 7.00% le avec balance method 9 Intered paid on cash & marketable securities 4.00% average tatoe method 00 Tax rate 40% 1 Dividend payout 3594 2 Mditional Borowing Limit $100 3 1. Build the model 34 Year 0 1 2 2 4 5 5 lacame datement es Sales 1,380,00 1.462.50 1,550,57 1.643.60 1,742.22 1,846.75 7 Cox of gold (1.214 12) (02.07 (1419) (1.445,041 (1.532) 28 Depreciation 199.75 (109.18) 1122.55) (137.27) (153.46) (171.26 e Interamento de 19.53 (1400) (14.001 (14.03 (14.00 Interesteamed on cash & marketable securities 3.53 1287 13.04 14.05 13.33 16.25 1 Profit before tax 129.35 138. 37 140.69 142.61 144.05 144.94 12 Taxes (5144 15535) (54.2 (570) 199621 (570) 33 Profit after tax 77.91 83.00 84.41 95.56 86.43 56.96 4 Dividende 33.96 20.06 29.54 20.05 30.25 30.4 15 Retained earnings 53.90 51.87 35.62 55.18 56.53 15 17 Balance sheet 38 Cash and marketable securities 95.60 102.40 109.54 115.05 121.96 129.27 9 Current acts - Other 207.00 210.42 232.50 246.54 261.33 207.01 Fixed assets or 1971 A Gros PPE 1,364.75 1.531.89 1,315.88 1.918.27 2.395.20 2 Depreciation - Accumulated (398,25 (90708) ( 160), 41 76725) 1921,21) 100247 13 Net fixed assets. Net PFE 965.00 1.023.96 1,085,40 1.150.52 1,219.55 1.292.73 1,261,60 1 345 78 1.512.11 1,602.84 1,619.01 15 16 Accounts payalle 41.40 43.8 49.31 52.27 55.40 7 Current liabilities - Other 9.00 7314 7,53 3.11 924 8 Notes Payable 112.24 58.29 3.41 19 Long-term debit 200.00 200.00 200,00 200.00 200.00 280.00 Comme sock 055.00 60800 059.00 598.99 50.10 1 Stock Issance Treasury stock) E2 Arcamalwird readernings IRO 242 2 207,20 358 41 400 N 45 11 3 Total liabilities and equity 1,269.60 1.276.22 1,283.24 1.243.87 1,291.76 1.390.12 54 15 calculations for an inte belas 8218 37 49 30 1 12 3 2. Use the model to provide recoomendation for decision maker in the firm. 4 Suppose that the desired sales growth rate is 6% or better. Based on this understanding and your model, please provide a specific recommendation for the firm's manager? B E H K L M N R LAB3: Multiple Plugs w Average Balance Method, Muti-y Take the assumptions as stated. Many assumptions are based on percent-of-sales, except depreciation and interests. Assumptions apply to the planning horizon only. Some assumptions may not apply to historical data because firm is revising the policy for the planning purpose. Dividend Payout Policy: Firm will pay out 35% of after-tax profit as cash dividend. Capital Rasing Policy: If required financing is needed, firm will obtain the funding from banks (NP) and then use stock issuance to obtain external funding. However, there is a limit on the additional amount of borrowing, Debt Limit: The firm has a total revolving credit limit of $212.24 million. The existing short-term debt balance (NP) is a part of this limit. Thus, firm can borrow an additional S100 million given its existing balance of $112.24 million in short-term debt. Excess Cash Policy: Firm will first pay off short-term debt. If all short-term debts are paid off, firm will use excess cash to buy hack shares. Model only needs to work within stated range of growth rate: -0.5% to 8%. Amption o Sales rowth 6.0% Asume sales growth to be between -0.5% and 8%. Your model was week within this rese. 1 Current acts - Other Sales 15% 2 Accounts payable Sales 34 3 Current liabilities - Other Sales 5% 4 Net fixed at Sales 70% 5 Cost of goods sold, Sales 83% 18 Cash & Mauriti Sales 7 Amal Depreciation rate 8% Amal depreciation is a percent of PPE at Cost using average balance method 13 Intereale en de 7.00% le avec balance method 9 Intered paid on cash & marketable securities 4.00% average tatoe method 00 Tax rate 40% 1 Dividend payout 3594 2 Mditional Borowing Limit $100 3 1. Build the model 34 Year 0 1 2 2 4 5 5 lacame datement es Sales 1,380,00 1.462.50 1,550,57 1.643.60 1,742.22 1,846.75 7 Cox of gold (1.214 12) (02.07 (1419) (1.445,041 (1.532) 28 Depreciation 199.75 (109.18) 1122.55) (137.27) (153.46) (171.26 e Interamento de 19.53 (1400) (14.001 (14.03 (14.00 Interesteamed on cash & marketable securities 3.53 1287 13.04 14.05 13.33 16.25 1 Profit before tax 129.35 138. 37 140.69 142.61 144.05 144.94 12 Taxes (5144 15535) (54.2 (570) 199621 (570) 33 Profit after tax 77.91 83.00 84.41 95.56 86.43 56.96 4 Dividende 33.96 20.06 29.54 20.05 30.25 30.4 15 Retained earnings 53.90 51.87 35.62 55.18 56.53 15 17 Balance sheet 38 Cash and marketable securities 95.60 102.40 109.54 115.05 121.96 129.27 9 Current acts - Other 207.00 210.42 232.50 246.54 261.33 207.01 Fixed assets or 1971 A Gros PPE 1,364.75 1.531.89 1,315.88 1.918.27 2.395.20 2 Depreciation - Accumulated (398,25 (90708) ( 160), 41 76725) 1921,21) 100247 13 Net fixed assets. Net PFE 965.00 1.023.96 1,085,40 1.150.52 1,219.55 1.292.73 1,261,60 1 345 78 1.512.11 1,602.84 1,619.01 15 16 Accounts payalle 41.40 43.8 49.31 52.27 55.40 7 Current liabilities - Other 9.00 7314 7,53 3.11 924 8 Notes Payable 112.24 58.29 3.41 19 Long-term debit 200.00 200.00 200,00 200.00 200.00 280.00 Comme sock 055.00 60800 059.00 598.99 50.10 1 Stock Issance Treasury stock) E2 Arcamalwird readernings IRO 242 2 207,20 358 41 400 N 45 11 3 Total liabilities and equity 1,269.60 1.276.22 1,283.24 1.243.87 1,291.76 1.390.12 54 15 calculations for an inte belas 8218 37 49 30 1 12 3 2. Use the model to provide recoomendation for decision maker in the firm. 4 Suppose that the desired sales growth rate is 6% or better. Based on this understanding and your model, please provide a specific recommendation for the firm's manager

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts