Question: Question 2 (only need to answer part b) (b)In late 2018, Starry Night Company acquired Irises Company. The statement of financial position of Irises Company

Question 2 (only need to answer part b)

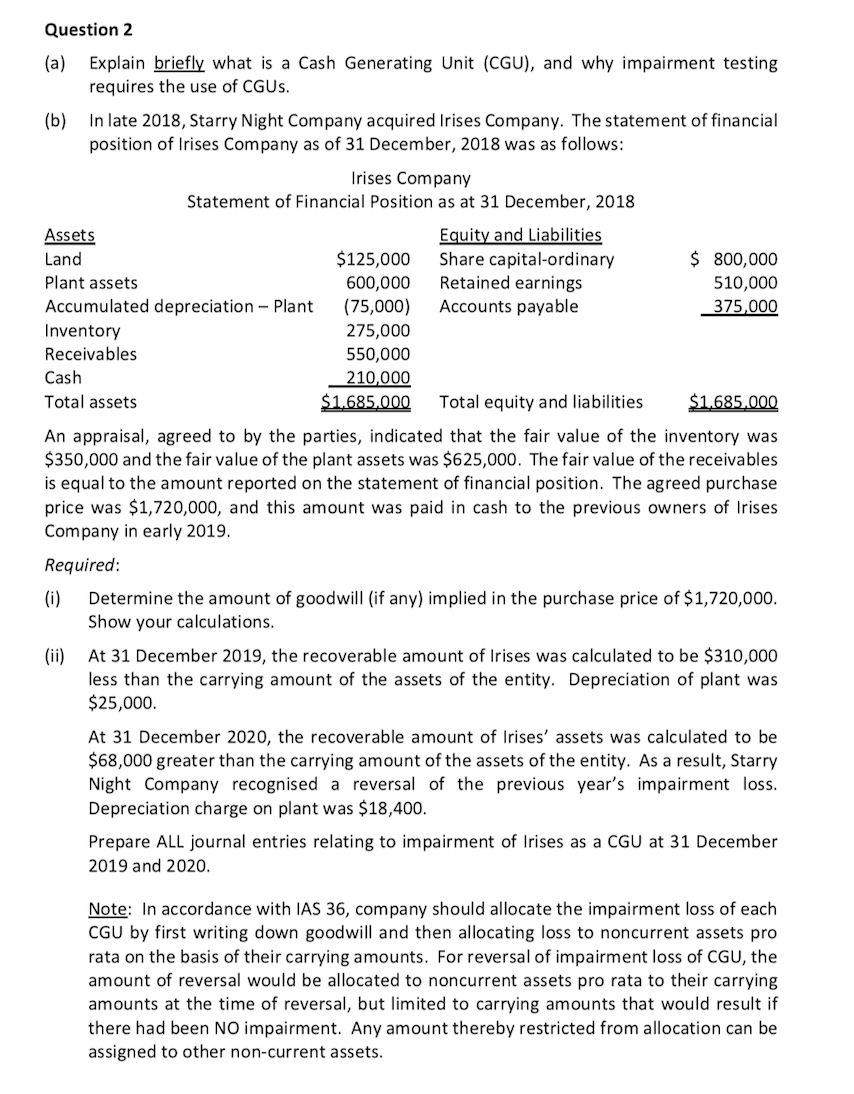

(b)In late 2018, Starry Night Company acquired Irises Company. The statement of financial position of Irises Company as of 31 December, 2018 was as follows:

Irises Company

Statement of Financial Position as at 31 December, 2018

Assets

Land $125,000

Plant assets $600,000

Accumulated depreciation - Plant ($75,000)

Inventory $275,000

Receivables $550,000

Cash $210,000

Total assets $1,685,000

Equity and Liabilities

Share capital-ordinary $ 800,000

Retained earnings $510,000

Accounts payable $375,000

Total equity and liabilities $1,685,000

An appraisal, agreed to by the parties, indicated that the fair value of the inventory was $350,000 and the fair value of the plant assets was $625,000. The fair value of the receivables is equal to the amount reported on the statement of financial position. The agreed purchase price was $1,720,000, and this amount was paid in cash to the previous owners of Irises Company in early 2019.

Required:

(i)Determine the amount of goodwill (if any) implied in the purchase price of $1,720,000. Show your calculations.

(ii)At 31 December 2019, the recoverable amount of Irises was calculated to be $310,000 less than the carrying amount of the assets of the entity. Depreciation of plant was $25,000.

At 31 December 2020, the recoverable amount of Irises' assets was calculated to be $68,000 greater than the carrying amount of the assets of the entity. As a result, Starry Night Company recognised a reversal of the previous year's impairment loss. Depreciation charge on plant was $18,400.

Please do journal entries relating to impairment of Irises as a CGU at 31 December 2019 and 2020.

Note: In accordance with IAS 36, company should allocate the impairment loss of each CGU by first writing down goodwill and then allocating loss to noncurrent assets pro rata on the basis of their carrying amounts. For reversal of impairment loss of CGU, the amount of reversal would be allocated to noncurrent assets pro rata to their carrying amounts at the time of reversal, but limited to carrying amounts that would result if there had been NO impairment. Any amount thereby restricted from allocation can be assigned to other non-current assets.

Question 2 {a} Explain brief what is a Cash Generating Unit {CGU}, and why impairment testing requires the use of (3605. lb} In late 2018, Starry Night Company acquired lrises Company. The statement ofnancial position of lrises Company as of 31 December, 2018 was as follows: lrises Company Statement of Financial Position as at 31 December, 2018 Assets Land $125,000 Plant assets 600,000 Accumulated depreciation Plant (75,000] Inventory 275,000 Receivables 550,000 Cash 210,000 Total assets W Eguiu and Liabilities Share capital-ordinary 5 800,000 Retained earnings 510,000 Accounts payable 3525.000 Total equity and liabilities M An appraisal, agreed to by the parties, indicated that the fair value of the inventory was $350,000 and the fair value ofthe plant assets was $625,000. The fair value of the receivables is equal to the amount reported on the statement of financial position. The agreed purchase price was $1,720,000, and this amount was paid in cash to the previous owners of lrises Company in early 2019. Required: {i} Determine the amount of goodwill (if any] implied in the purchase price of$1,720,000. Show your calculations. {ii} At 31 December 2019, the recoverable amount of lrises was calculated to be $310,000 less than the carrying amount of the assets of the entity. Depreciation of plant was $25,000. At 31 December 2020, the recoverable amount of lrises' assets was calculated to be $68,000 greater than the carrying amount ofthe assets ofthe entity. As a result, Starry Night Company recognised a reversal of the previous year's impairment loss. Depreciation charge on plant was $18,400. Prepare ALL journal entries relating to impairment of lrises as a CGU at 31 December 2019 and 2020. Dine: In accordance with IAS 36, company should allocate the impairment loss of each CGU by first writing down goodwill and then allocating loss to noncurrent assets pro rata on the basis of their carrying amounts. For reversal of impairment loss of CGU, the amount of reversal would be allocated to noncurrent assets pro rate to their carrying amounts at the time of reversal, but limited to carrying amounts that would result if there had been N0 impairment. Any amount thereby restricted from allocation can be assigned to other non-current assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts