Question: question 2 only Page Design a swap that will net a bank, acting as intermediary, 50 basis points per annum. Make the swap equally attractive

question 2 only

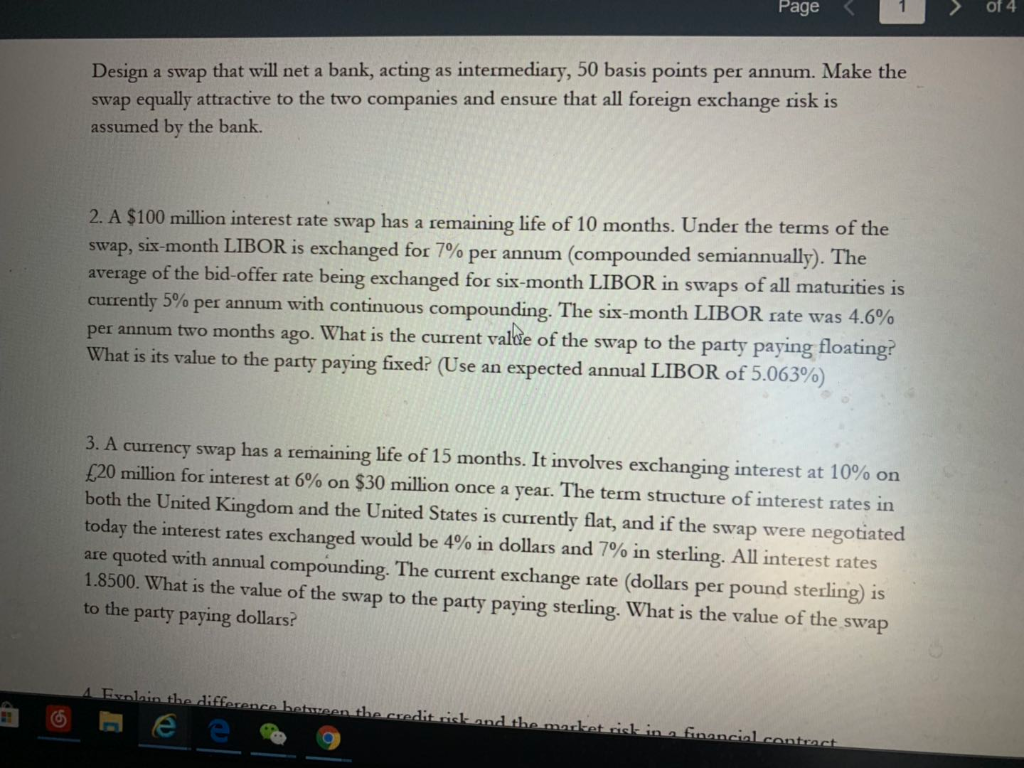

Page Design a swap that will net a bank, acting as intermediary, 50 basis points per annum. Make the swap equally attractive to the two companies and ensure that all foreign exchange risk is assumed by the bank. 2. A $100 million interest rate swap has a remaining life of 10 months. Under the terms of the swap,sx-month LIBOR is exchanged for 7% per annum (compounded semiannually . The average of the bid offer rate being exchanged for six-month LIBOR in swaps of all maturities is currently 5% per annum with continuous compounding. per annum two months ago. What is the cutrent valde of the swap to the party paying floating? What is its value to the party paying fixed? (Use an expected annual LIBOR of 5.063%) The six-month LIBOR rate was 4.6% 3. A currency swap has a remaining life of 15 months. It involves exchanging interest at 10% on 20 million for interest at 6% on $30 million once a year. The term structure of interest rates in both the United Kingdom and the United States is currently flat, and if the swap were negotiated today the interest rates exchanged would be 4% in dollars and 7% in sterling. All interest rates ate quoted with annual compounding. The current exchange tate (dollars per pound sterling) is 1.8500. What is the value of the swap to the party paying sterling. What is the value of the swap to the party paying dollars? Page Design a swap that will net a bank, acting as intermediary, 50 basis points per annum. Make the swap equally attractive to the two companies and ensure that all foreign exchange risk is assumed by the bank. 2. A $100 million interest rate swap has a remaining life of 10 months. Under the terms of the swap,sx-month LIBOR is exchanged for 7% per annum (compounded semiannually . The average of the bid offer rate being exchanged for six-month LIBOR in swaps of all maturities is currently 5% per annum with continuous compounding. per annum two months ago. What is the cutrent valde of the swap to the party paying floating? What is its value to the party paying fixed? (Use an expected annual LIBOR of 5.063%) The six-month LIBOR rate was 4.6% 3. A currency swap has a remaining life of 15 months. It involves exchanging interest at 10% on 20 million for interest at 6% on $30 million once a year. The term structure of interest rates in both the United Kingdom and the United States is currently flat, and if the swap were negotiated today the interest rates exchanged would be 4% in dollars and 7% in sterling. All interest rates ate quoted with annual compounding. The current exchange tate (dollars per pound sterling) is 1.8500. What is the value of the swap to the party paying sterling. What is the value of the swap to the party paying dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts