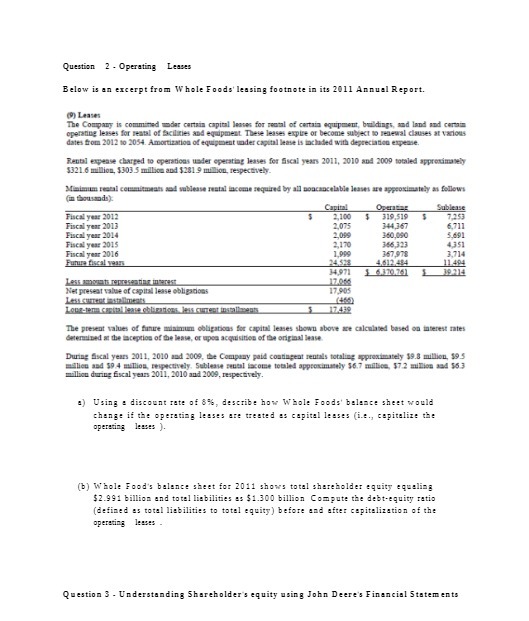

Question: Question 2 - Operating Leases Below is an excerpt from Whole Foods' leasing footnote in its 2011 Annual Report. () Leaves The Company is committed

Question 2 - Operating Leases Below is an excerpt from Whole Foods' leasing footnote in its 2011 Annual Report. () Leaves The Company is committed wdar certain capital leases for rental of certain equipment, buildings, and land and curtain operating leases for rental of bailities and equipment. These leases expire or become subject to renewal clauses at various dates from 2012 to 2034. Amortization of eq at under capital leave is included with depreciation expense. Rental expease charged to operations under operating leaves for fiscal years 2011, 2010 and 2009 totaled approximately 1321.6 million, 1303 5 million and $201.9 million, respectively. Minimum raul commitmat sad voblesse ratal lacome required by all ponchocolable lease are approximately in follows Capital Sublense Fiscal year 2012 2,100 319,519 7.253 Fiscal year 2013 2 075 14,367 6.711 Fiscal year 2014 2,089 350,090 3.801 Fiscal year 2015 2.170 346.323 4.351 Fiscal year 2016 1.ppp 3,714 Future fiscal year 4.812.94 11 404 19 314 Net present value of capital lease obligations 17.905 17.432 The present values of future minimum obligations for capital leases shown above are calculated based on interest rates Seteraimed at the tacoption of the Meow, or upon acquisition of the original lease During fiscal years 2011, 2010 and 2009, the Company paid contingent rentals totaling approximately $9.8 million, 193 million and $9:4 mullion, respectively, Sublease routal iscome totaled approvimmtely $6.7 million, $72 mullion and $63 million during fiscal years 2011, 2010 and 2009, respectively. :) Using : discount rate of 8%%, describe how Whole Foods' balance sheet would change if the operating leases are treated as capital leases (i.e., capitalize the operating leases ). (b) Whole Food's balance sheet for 2011 shows total shareholder equity equaling $2.991 billion and totel liabilities as $1.300 billion Compute the debt-equity ratio (defined as total liabilities to total equity) before and after capitalization of the operating losses Question 3 - Understanding Shareholder's equity using John Deere's Financial Statements