Question: Question 2 - Optimisation (30 marks] Ultimo Savings Bank (USB) has $100 million in new funds that need to be allocated to home loans, personal

![Question 2 - Optimisation (30 marks] Ultimo Savings Bank (USB) has](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ffa1945be02_07566ffa193c59f3.jpg)

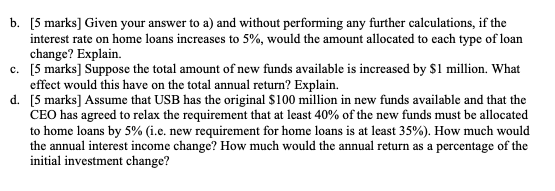

Question 2 - Optimisation (30 marks] Ultimo Savings Bank (USB) has $100 million in new funds that need to be allocated to home loans, personal loans, and car loans. The annual interest rates for the three types of loans are 3% for home loans, 10% for personal loans, and 7% for car loans. The bank's CEO has decided that at least 40% of the new funds must be allocated to home loans. In addition, the CEO has instructed that the amount allocated to personal loans cannot exceed 60% of the amount allocated to car loans. a. [15 marks] How much should the bank allocate to each type of loan to maximise the total annual return for the new funds? What is the total annual interest income? What is the annual return as a percentage of the initial investment? Hint: Determine the objective function and constraints for this optimisation problem and then use the Excel add-in Solver to find an optimal solution. b. [5 marks] Given your answer to a) and without performing any further calculations, if the interest rate on home loans increases to 5%, would the amount allocated to each type of loan change? Explain. c. [5 marks] Suppose the total amount of new funds available is increased by $1 million. What effect would this have on the total annual return? Explain. d. [5 marks] Assume that USB has the original $100 million in new funds available and that the CEO has agreed to relax the requirement that at least 40% of the new funds must be allocated to home loans by 5% (i.e. new requirement for home loans is at least 35%). How much would the annual interest income change? How much would the annual return as a percentage of the initial investment change? Question 2 - Optimisation (30 marks] Ultimo Savings Bank (USB) has $100 million in new funds that need to be allocated to home loans, personal loans, and car loans. The annual interest rates for the three types of loans are 3% for home loans, 10% for personal loans, and 7% for car loans. The bank's CEO has decided that at least 40% of the new funds must be allocated to home loans. In addition, the CEO has instructed that the amount allocated to personal loans cannot exceed 60% of the amount allocated to car loans. a. [15 marks] How much should the bank allocate to each type of loan to maximise the total annual return for the new funds? What is the total annual interest income? What is the annual return as a percentage of the initial investment? Hint: Determine the objective function and constraints for this optimisation problem and then use the Excel add-in Solver to find an optimal solution. b. [5 marks] Given your answer to a) and without performing any further calculations, if the interest rate on home loans increases to 5%, would the amount allocated to each type of loan change? Explain. c. [5 marks] Suppose the total amount of new funds available is increased by $1 million. What effect would this have on the total annual return? Explain. d. [5 marks] Assume that USB has the original $100 million in new funds available and that the CEO has agreed to relax the requirement that at least 40% of the new funds must be allocated to home loans by 5% (i.e. new requirement for home loans is at least 35%). How much would the annual interest income change? How much would the annual return as a percentage of the initial investment change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts