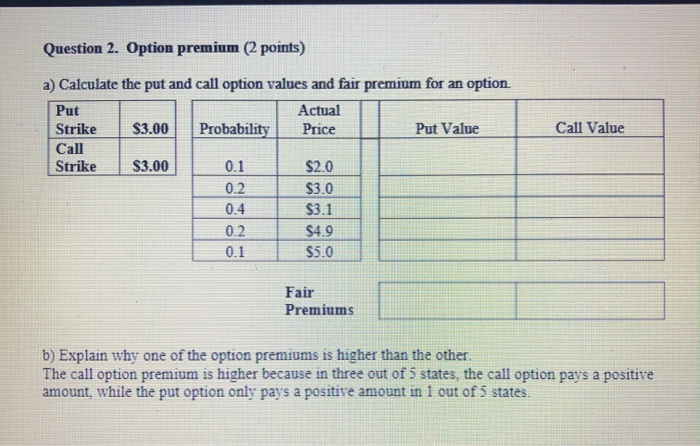

Question: Question 2. Option premium (2 points) Call Value a) Calculate the put and call option values and fair premium for an option. Put Actual Strike

Question 2. Option premium (2 points) Call Value a) Calculate the put and call option values and fair premium for an option. Put Actual Strike $3.00 Probability Price Put Value Call Strike $3.00 $2.0 0.2 $3.0 $3.1 $4.9 $5.0 0.1 Fair Premiums b) Explain why one of the option premiums is higher than the other. The call option premium is higher because in three out of 5 states, the call option pays a positive amount, while the put option only pays a positive amount in 1 out of 5 states. Question 2. Option premium (2 points) Call Value a) Calculate the put and call option values and fair premium for an option. Put Actual Strike $3.00 Probability Price Put Value Call Strike $3.00 $2.0 0.2 $3.0 $3.1 $4.9 $5.0 0.1 Fair Premiums b) Explain why one of the option premiums is higher than the other. The call option premium is higher because in three out of 5 states, the call option pays a positive amount, while the put option only pays a positive amount in 1 out of 5 states

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts