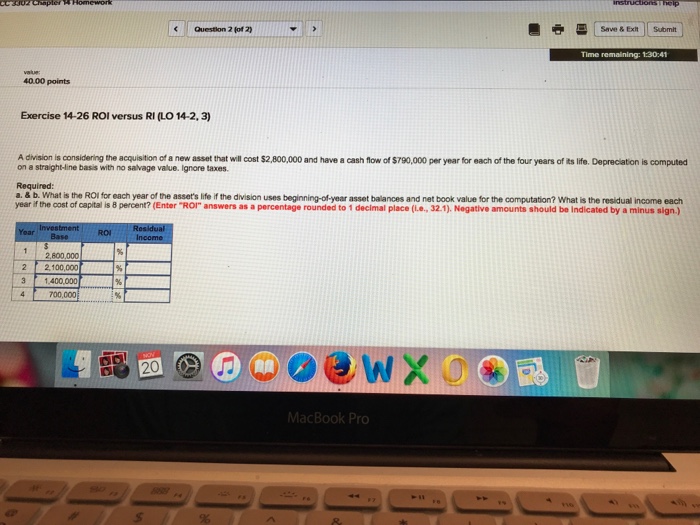

Question: Question 2 (ot 2 Save & Exlt Submit Time remaining: 1:30:41 40.00 points Exercise 14-26 ROI versus RI (LO 14-2, 3) A division is considering

Question 2 (ot 2 Save & Exlt Submit Time remaining: 1:30:41 40.00 points Exercise 14-26 ROI versus RI (LO 14-2, 3) A division is considering the acquisition of a new asset that will cost $2,800,000 and have a cash flow of $790,000 per year for each of the four years of its life. Depreciaton is computed on a straight-line basis with no salvage value. Ignore taxes. Required: a & b. What is the ROl for each year of the assets If f the division uses beginning-of year asset baiances and net book valiue for the computation? What is the residual income each year if the cost of capital is 8 percent? (Enter ROi" answers as a percentage rounded to 1 declmal place (l.e., 32.1), Nogative amounts should be Indicated by a minus sign.) ROI 2,800,000 22,100,000 3 1.400.000 700,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts