Question: Question 2 Part A (5 marks) It is 16 July. A US company has a portfolio of stocks worth USD 100 million. The beta of

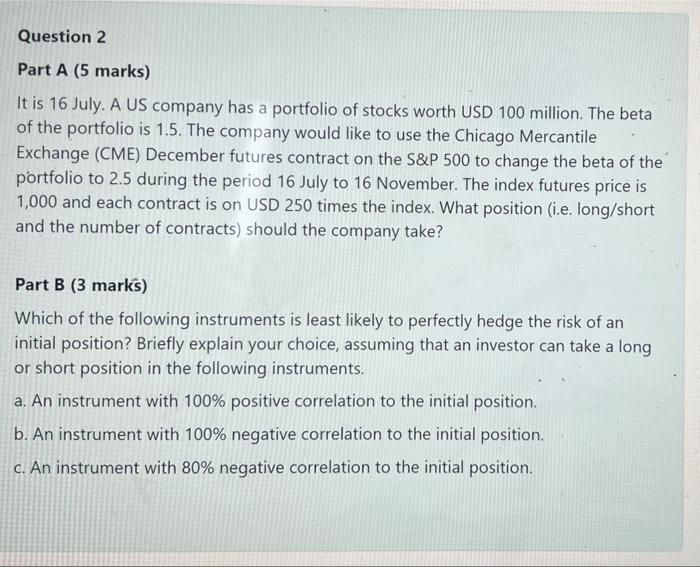

Question 2 Part A (5 marks) It is 16 July. A US company has a portfolio of stocks worth USD 100 million. The beta of the portfolio is 1.5. The company would like to use the Chicago Mercantile Exchange (CME) December futures contract on the S&P 500 to change the beta of the portfolio to 2.5 during the period 16 July to 16 November. The index futures price is 1,000 and each contract is on USD 250 times the index. What position (i.e. long/short and the number of contracts) should the company take? Part B (3 marks) Which of the following instruments is least likely to perfectly hedge the risk of an initial position? Briefly explain your choice, assuming that an investor can take a long or short position in the following instruments. a. An instrument with 100% positive correlation to the initial position. b. An instrument with 100% negative correlation to the initial position. c. An instrument with 80% negative correlation to the initial position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts