Question: question 2 please 1. (worth 10 points) When the CFO of Westinghome Electronic Company wants to determine the cost of common equity (also referred to

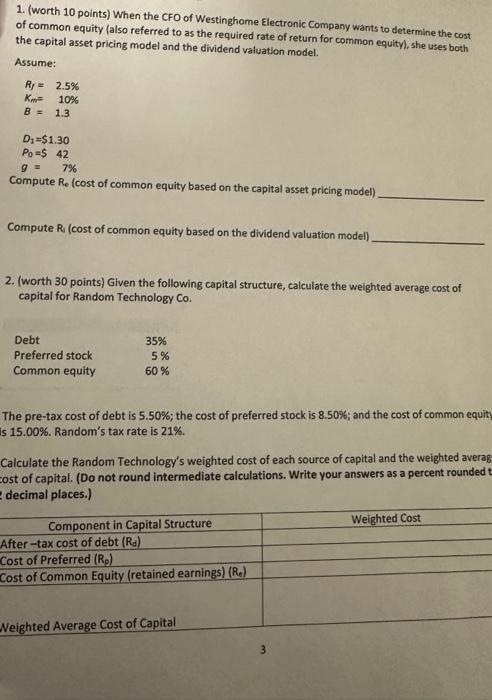

1. (worth 10 points) When the CFO of Westinghome Electronic Company wants to determine the cost of common equity (also referred to as the required rate of return for common equity), she uses both the capital asset pricing model and the dividend valuation model. Assume: Rl=2.5%Km=10%B=1.3 D1=$1.30P0=$42g=7% Compute Re (cost of common equity based on the capital asset pricing model) Compute R4 (cost of common equity based on the dividend valuation model) 2. (worth 30 points) Given the following capital structure, calculate the weighted average cost of capital for Random Technology Co. The pre-tax cost of debt is 5.50%; the cost of preferred stock is 8.50%; and the cost of common equity is 15.00%. Random's tax rate is 21%. Calculate the Random Technology's weighted cost of each source of capital and the weighted averag cost of capital. (Do not round intermediate calculations. Write your answers as a percent rounded t decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts