Question: Question 2 Please don't round up your answers at all. The best approach is to enter your formulas straight into the answer cells. At time

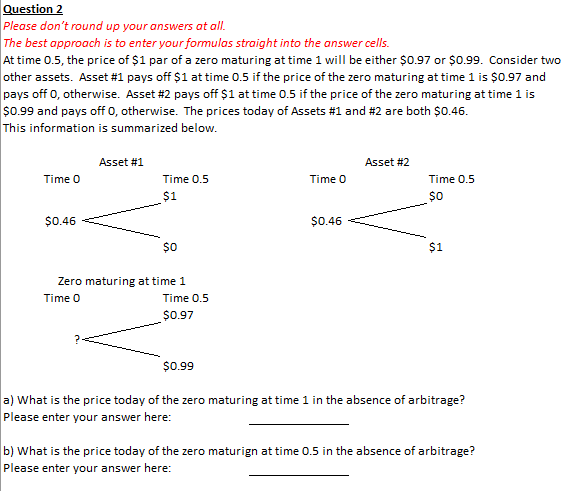

Question 2 Please don't round up your answers at all. The best approach is to enter your formulas straight into the answer cells. At time 0.5, the price of $1 par of a zero maturing at time 1 will be either $0.97 or $0.99. Consider two other assets. Asset #1 pays off $1 at time 0.5 if the price of the zero maturing at time 1 is $0.97 and pays off O, otherwise. Asset #2 pays off $1 at time 0.5 if the price of the zero maturing at time 1 is $0.99 and pays off O, otherwise. The prices today of Assets #1 and #2 are both $0.46. This information is summarized below. Asset #1 Asset #2 Time 0 Time 0 Time 0.5 $1 Time 0.5 $0 $0.46 $0.46 $0 $1 Zero maturing at time 1 Time 0 Time 0.5 $0.97 $0.99 a) What is the price today of the zero maturing at time 1 in the absence of arbitrage? Please enter your answer here: b) What is the price today of the zero maturign at time 0.5 in the absence of arbitrage? Please enter your answer here: Question 2 Please don't round up your answers at all. The best approach is to enter your formulas straight into the answer cells. At time 0.5, the price of $1 par of a zero maturing at time 1 will be either $0.97 or $0.99. Consider two other assets. Asset #1 pays off $1 at time 0.5 if the price of the zero maturing at time 1 is $0.97 and pays off O, otherwise. Asset #2 pays off $1 at time 0.5 if the price of the zero maturing at time 1 is $0.99 and pays off O, otherwise. The prices today of Assets #1 and #2 are both $0.46. This information is summarized below. Asset #1 Asset #2 Time 0 Time 0 Time 0.5 $1 Time 0.5 $0 $0.46 $0.46 $0 $1 Zero maturing at time 1 Time 0 Time 0.5 $0.97 $0.99 a) What is the price today of the zero maturing at time 1 in the absence of arbitrage? Please enter your answer here: b) What is the price today of the zero maturign at time 0.5 in the absence of arbitrage? Please enter your answer here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts