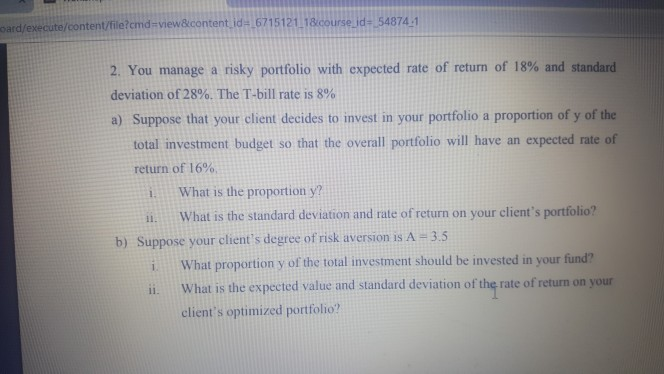

Question: question 2 please oard/execute/content/file?cmd-view&content id6715121 18course.id-54874-1 2. You manage a risky portfolio with expected rate of return of 18% and standard deviation of28%. The T-bill

question 2 please

oard/execute/content/file?cmd-view&content id6715121 18course.id-54874-1 2. You manage a risky portfolio with expected rate of return of 18% and standard deviation of28%. The T-bill rate is 8% a) Suppose that your client decides to invest in your portfolio a proportion of y of the total investment budget so that the overall portfolio will have an expected rate of return of 16%. iWhat is the proportion y? i. What is the standard deviation and rate of return on your client's portfolio? i. What proportion y of the total investment should be invested in your fund? i. What is the expeceted value and standard deviation of the rate of return on your b) Suppose your client's degree of risk aversion is A-3.5 client's optimized portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts