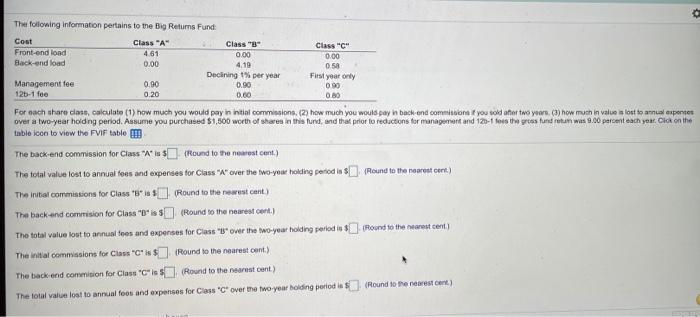

Question: question 2 . please provide the answer for the boxes below and right answers only plz The following information pertains to the Big Returns Fund

The following information pertains to the Big Returns Fund Cost Class "A" Class "3 Class "C" Front-end load 4.61 0.00 0.00 Back-end load 0.00 4.19 058 Declining 1% per year First year only Management tee 0.00 0.90 090 125-1 foe 0.20 0.60 0.00 For each share class, calculate (1) how much you would pay in initial commissions, (2) how much you would pay in back-end commitmel you sold after two years.() how much in value is lost to annual expertes over a two-year holding period. Assume you purchased $1,500 worth of shares in this fund, and that prior to reductions for management and 120-1 fois the grees fund rotun was 9.00 percent each year. Click on the tablo icon to view the Fif table The back-end commission for Class Round to the nearest cent) The total value lost to annual fees and expenses for Class "" over the two-yee holding period in Round to the nearest cert) The initial commissions for Class **** (Round to the newest cant) The back and commision for Class "$(Round to the nearest cont.) The total value lost to annual fees and expenses for Class "ower the wo-year holding periods & Roond to the nearest cent) The initial commissions for Class "C"$Round to the nearest cont.) The back end commision for Class "C" (Round to the nearest cant) (Round to the nearest cent) The total value lost to annual foos and expenses for Class 'Cover the two year holding period is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts