Question: Question 2: Pre-sale transaction (25 points): You are a developer who owns a land site to be developed in one year, and you have the

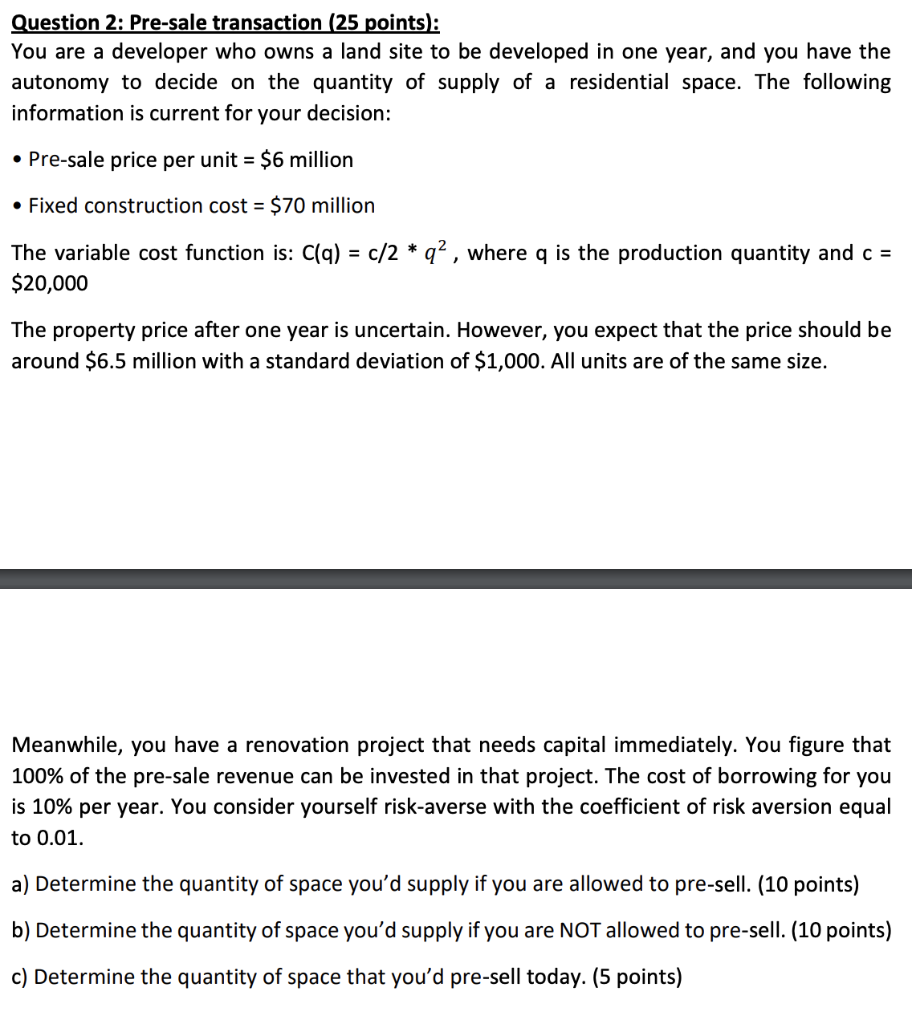

Question 2: Pre-sale transaction (25 points): You are a developer who owns a land site to be developed in one year, and you have the autonomy to decide on the quantity of supply of a residential space. The following information is current for your decision: Pre-sale price per unit = $6 million Fixed construction cost = $70 million = The variable cost function is: C(q) = c/2 * q?, where q is the production quantity and c = $20,000 The property price after one year is uncertain. However, you expect that the price should be around $6.5 million with a standard deviation of $1,000. All units are of the same size. Meanwhile, you have a renovation project that needs capital immediately. You figure that 100% of the pre-sale revenue can be invested in that project. The cost of borrowing for you is 10% per year. You consider yourself risk-averse with the coefficient of risk aversion equal to 0.01. a) Determine the quantity of space you'd supply if you are allowed to pre-sell. (10 points) b) Determine the quantity of space you'd supply if you are NOT allowed to pre-sell. (10 points) c) Determine the quantity of space that you'd pre-sell today. (5 points) Question 2: Pre-sale transaction (25 points): You are a developer who owns a land site to be developed in one year, and you have the autonomy to decide on the quantity of supply of a residential space. The following information is current for your decision: Pre-sale price per unit = $6 million Fixed construction cost = $70 million = The variable cost function is: C(q) = c/2 * q?, where q is the production quantity and c = $20,000 The property price after one year is uncertain. However, you expect that the price should be around $6.5 million with a standard deviation of $1,000. All units are of the same size. Meanwhile, you have a renovation project that needs capital immediately. You figure that 100% of the pre-sale revenue can be invested in that project. The cost of borrowing for you is 10% per year. You consider yourself risk-averse with the coefficient of risk aversion equal to 0.01. a) Determine the quantity of space you'd supply if you are allowed to pre-sell. (10 points) b) Determine the quantity of space you'd supply if you are NOT allowed to pre-sell. (10 points) c) Determine the quantity of space that you'd pre-sell today. (5 points)

Step by Step Solution

There are 3 Steps involved in it

To solve these problems well use concepts from economics and finance specifically focusing on cost f... View full answer

Get step-by-step solutions from verified subject matter experts