Question: Question 2 Princess Products is considering replacing all its plastic injection molding machine with a new, more efficient one. The existing machine was purchased five

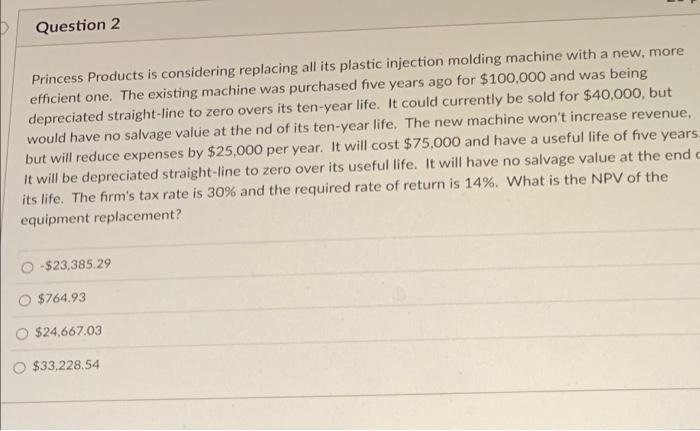

Question 2 Princess Products is considering replacing all its plastic injection molding machine with a new, more efficient one. The existing machine was purchased five years ago for $100,000 and was being depreciated straight-line to zero overs its ten-year life. It could currently be sold for $40,000, but would have no salvage value at the nd of its ten-year life. The new machine won't increase revenue, but will reduce expenses by $25,000 per year. It will cost $75,000 and have a useful life of five years. It will be depreciated straight-line to zero over its useful life. It will have no salvage value at the end c its life. The firm's tax rate is 30% and the required rate of return is 14%. What is the NPV of the equipment replacement? -$23,385.29 $764.93 $24,667.03 $33,228.54

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts