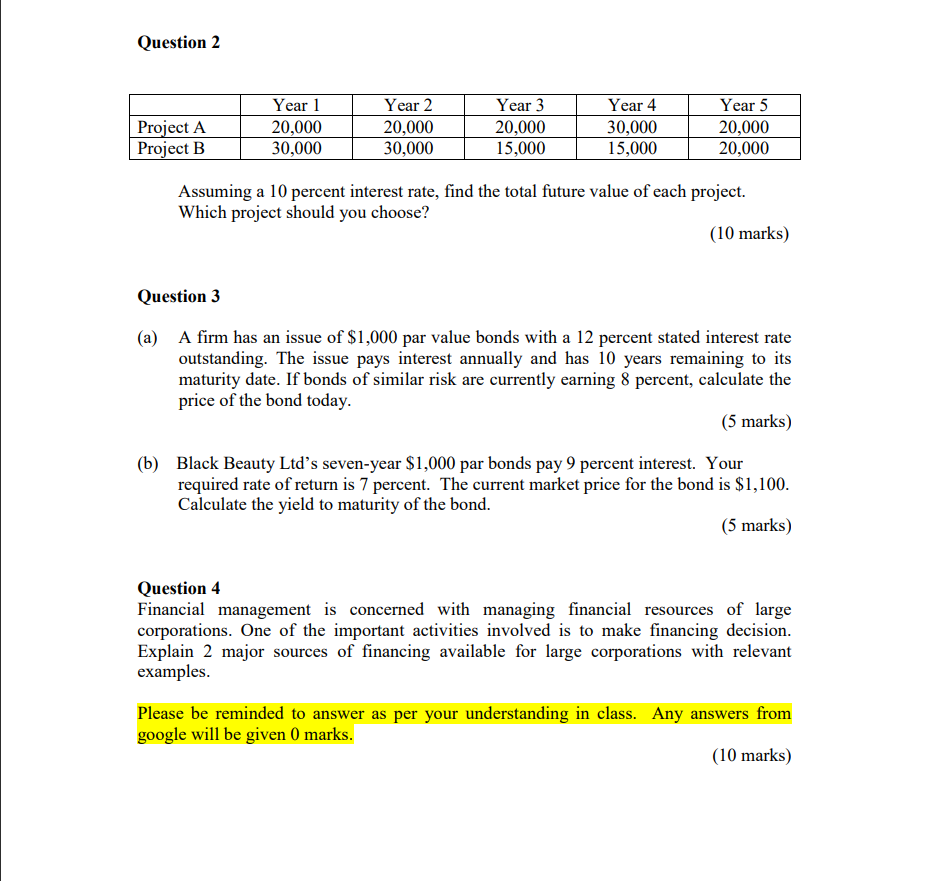

Question: Question 2 Project A Project B Year 1 20,000 30,000 Year 2 20,000 30,000 Year 3 20,000 15,000 Year 4 30,000 15,000 Year 5 20,000

Question 2 Project A Project B Year 1 20,000 30,000 Year 2 20,000 30,000 Year 3 20,000 15,000 Year 4 30,000 15,000 Year 5 20,000 20,000 Assuming a 10 percent interest rate, find the total future value of each project. Which project should you choose? (10 marks) Question 3 (a) A firm has an issue of $1,000 par value bonds with a 12 percent stated interest rate outstanding. The issue pays interest annually and has 10 years remaining to its maturity date. If bonds of similar risk are currently earning 8 percent, calculate the price of the bond today. (5 marks) (b) Black Beauty Ltd's seven-year $1,000 par bonds pay 9 percent interest. Your required rate of return is 7 percent. The current market price for the bond is $1,100. Calculate the yield to maturity of the bond. (5 marks) Question 4 Financial management is concerned with managing financial resources of large corporations. One of the important activities involved is to make financing decision. Explain 2 major sources of financing available for large corporations with relevant examples. Please be reminded to answer as per your understanding in class. Any answers from google will be given 0 marks. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts