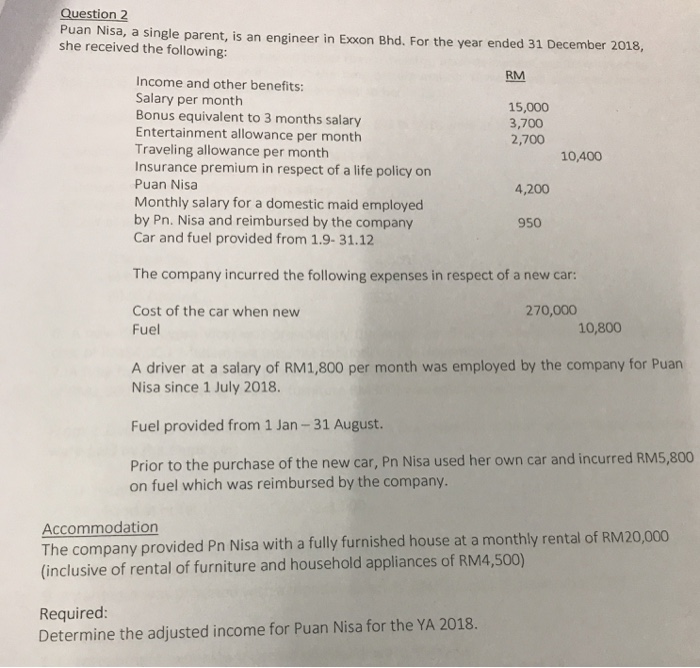

Question: Question 2 Puan Nisa, a single parent, is an engineer in Exxon Bhd. For the year ended 31 December 2018, she received the following: RM

Question 2 Puan Nisa, a single parent, is an engineer in Exxon Bhd. For the year ended 31 December 2018, she received the following: RM Income and other benefits: Salary per month Bonus equivalent to 3 months salary Entertainment allowance per month Traveling allowance per month Insurance premium in respect of a life policy on Puan Nisa Monthly salary for a domestic maid employed by Pn. Nisa and reimbursed by the company Car and fuel provided from 1.9- 31.12 15,000 3,700 2,700 10,400 4,200 950 The company incurred the following expenses in respect of a new car: 270,000 Cost of the car when new Fuel 10,800 A driver at a salary of RM1,800 per month was employed by the company for Puan Nisa since 1 July 2018. Fuel provided from 1 Jan-31 August. Prior to the purchase of the new car, Pn Nisa used her own car and incurred RM5,800 on fuel which was reimbursed by the company. Accommodation The company provided Pn Nisa with a fully furnished house at a monthly rental of RM20,000 (inclusive of rental of furniture and household appliances of RM4,500) Required: Determine the adjusted income for Puan Nisa for the YA 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts