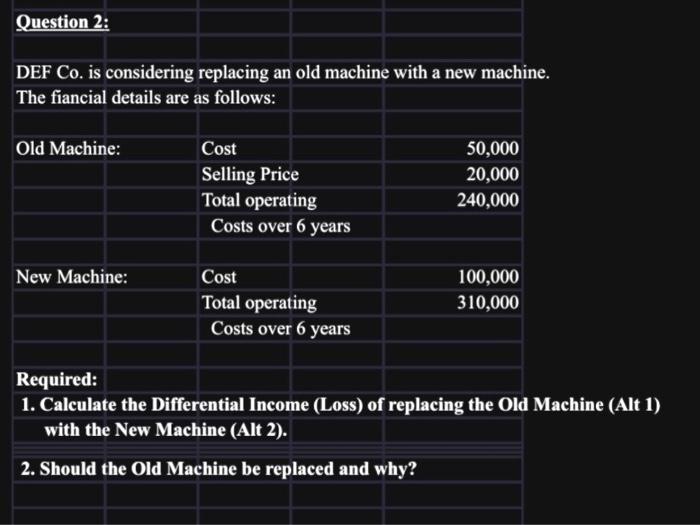

Question: question #2 Question 2: DEF Co. is considering replacing an old machine with a new machine. The fiancial details are as follows: begin{tabular}{|l|l|r|} hline Old

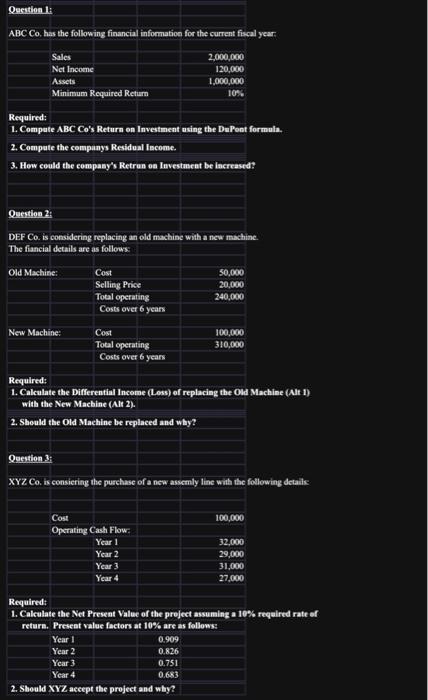

Question 2: DEF Co. is considering replacing an old machine with a new machine. The fiancial details are as follows: \begin{tabular}{|l|l|r|} \hline Old Machine: & Cost & 50,000 \\ \hline & Selling Price & 20,000 \\ \hline & Total operating & 240,000 \\ \hline & Costs over 6 years & \\ \hline & & \\ \hline New Machine: & Cost & 100,000 \\ \hline & Total operating & 310,000 \\ \hline & Costs over 6 years & \\ \hline \end{tabular} Required: 1. Calculate the Differential Income (Loss) of replacing the Old Machine (Alt 1) with the New Machine (Alt 2). 2. Should the Old Machine be replaced and why? Quention 1: ABC Co, has the following financial information for the current fiscal year: 2. Compute the companys Residual Income. 3. How could the compasy's Retrun on Investancat be lacreased? Question 2: DEF Co. is considering replacing an old machine with a new machine. The fiancial details are as follows \begin{tabular}{|l|l|r|} \hline Old Machine: & Cost & 50,000 \\ \hline & Selling Price & 20,000 \\ \hline & Total operating Costs over 6 years & 240,000 \\ \hline & & \\ \hline New Machine & Cost & 100,000 \\ \hline & Total operating Costs over 6 years & 310,000 \\ \hline \end{tabular} Required: 1. Calculate the Differential Inceme (Loss) of replacing the Oad Machine (Alt 1) with the New Machine (AIt 2). 2. Should the Old Machine be replaced and why? Question 3. XYZ Co, is consiering the purchase of a new assemly line with the following detaile Requiredt 1. Calculate the Net Present Value of the preject assuming a 10% required rate of retare. Preseat value factors at 10% are as follows: \begin{tabular}{|c|r|} \hline retare. Preseat value iactori atiox, are as ioidows \\ \hline Year 1 & 0.909 \\ \hline Year 2 & 0.826 \\ \hline Year 3 & 0.751 \\ \hline Year 4 & 0.683 \\ \hline 2. Should XYZ aceept the project and why? \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts