Question: Question 2: Question 3: Question 4: Please answer all parts thank you Exercise 11.8 (Static) Volume Trade-Off Decisions [LO11.5, LO11-6] Barlow Company manufactures three products

![you Exercise 11.8 (Static) Volume Trade-Off Decisions [LO11.5, LO11-6] Barlow Company manufactures](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f71d31c2e1d_89766f71d313aefd.jpg)

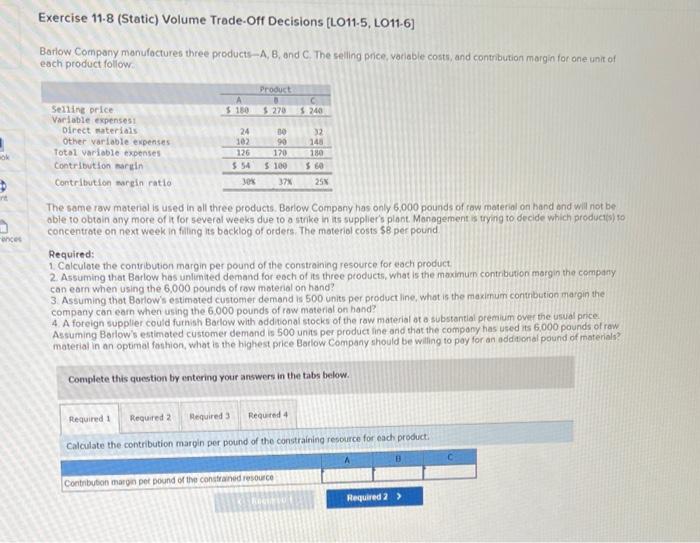

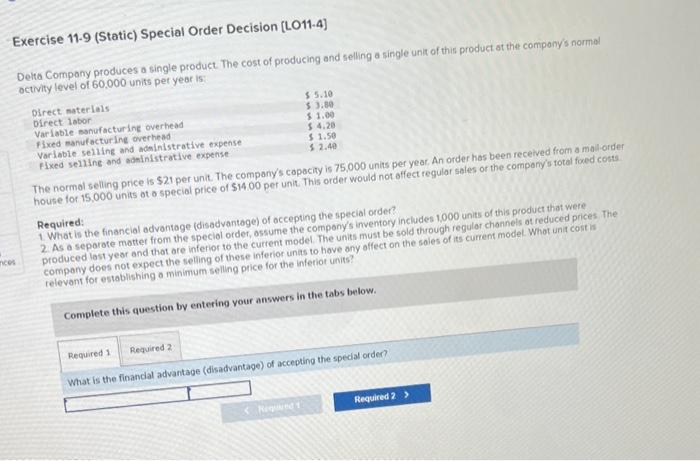

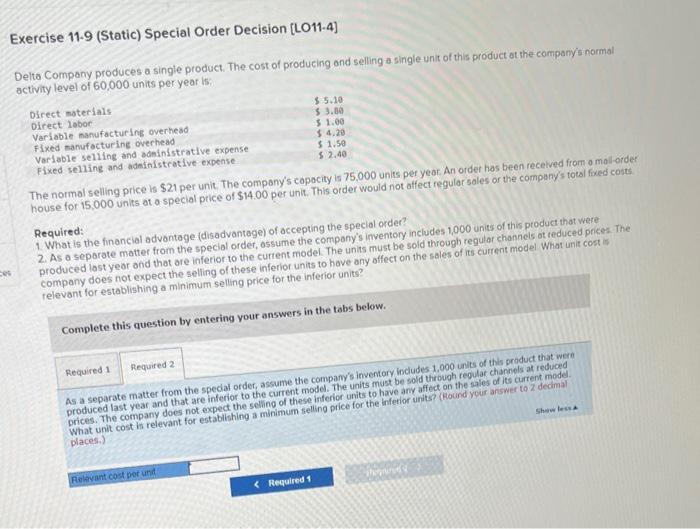

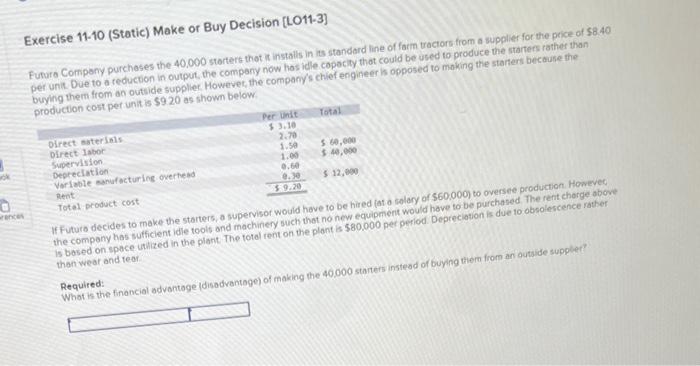

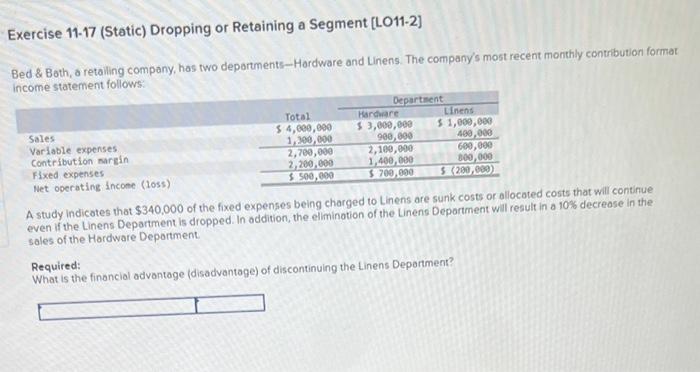

Exercise 11.8 (Static) Volume Trade-Off Decisions [LO11.5, LO11-6] Barlow Company manufactures three products - A, B, and C. The seling price, variable costs, and contribution margin for one unir of each product follow. The same raw material is used in all three products. Barlow Company has only 6.000 pounds of row material on hand and will not be oble to obtain any more of it for several weeks due to a strike in its supplier's plant. Monagement is tryng to decide which produciplo concentrote on next week in falling its backlog of orders. The materiol costs $8 per pound Required: 1. Calculote the coniribution margin per pound of the constraining resource for each product. 2. Assuming that Barlow has unlimited demand for esch of its three products, what is the maximum contrbution margin the company can earn when using the 6.000 pounds of row moterial on hand? 3. Assuming that Borlow's estimated customer demand is 500 units per product line, whot is the maximum contribution margin the company can earn when using the 6.000 pounds of row material on hand? 4. A foreign supplier could furnish Batlow with additional stocks of the raw material at a substantial premium over the usual price: Assuming Borlow's estimoted customer demand is 500 units per product ine and that the company has used its 6.000 pounds of raw material in an optimal fashion, what is the highest price Barlow Company should be willing to pay for an additional pound of materials? Complete this question ty enterino your answers in the tabs below. Calculate the contribution margin per pound of the constraining resource for each product: Barlow Company manufactures three products A,B, and C. The selling price, variable costs, and contribution margin for one un each product follow: The same raw material is used in all three products. Barlow Company has only 6,000 pounds of row material on hand and will not able to obtain any more of it for several weeks due to a strike in its supplier's plant. Management is trying to decide which product. concentrate on next week in filling its bocklog of orders. The material costs $8 per pound. Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2. Assuming that Barlow has unlimited demand for each of its three products, what is the maximum contribution margin the compan can earn when using the 6.000 pounds of raw material on hand? 3. Assuming that Barlow's estimated customer demand is 500 units per product line, what is the maximum contribution margin the company can earn when using the 6.000 pounds of raw material on hand? 4. A foreign supplier could furnish Barlow with additional stocks of the raw moterial at a substantial premium over the usual price. Assuming Barlow's estimated customer demand is 500 units per product line ond that the company has used its 6.000 pounds of ra moterial in on optimal fashion, what is the highest price Barlow Company should be willing to poy for an additional pound of material Complete this question by entering your answers in the tabs below. Assuming that Barlow has unlimited demand for each of its three products, what is the maximum contribution margin the company can eam when using the 6,000 pounds of raw material on hand? Barlow Company manufactures three products-A, B, and C. The selling price, variable costs, and contribution margin for one u each product follow: The same raw material is used in all three products. Barlow Company has only 6,000 pounds of raw material on hand and will able to obtain any more of it for several weeks due to a strike in its supplier's plant. Management is trying to decide which prod concentrate on next week in filling its backlog of orders. The material costs $8 per pound. Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2. Assuming that Barlow has unlimited demand for each of its three products, what is the maximum contribution margin the cor can earn when using the 6,000 pounds of raw material on hand? 3. Assuming that Barlow's estimated customer demand is 500 units per product line, what is the maximum contribution margin company can earn when using the 6,000 pounds of raw material on hand? 4. A foreign supplier could furnish Barlow with additional stocks of the raw material at a substantial premium over the usual pni Assuming Barlow's estimated customer demand is 500 units per product line and that the company has used its 6.000 pound: material in an optimal fashion, what is the highest price Barlow Company should be willing to pay for an additional pound of mi Complete this question by entering your answers in the tabs below. Assuming that Barlow's estimated customer demand is 500 units per product line, what is the maximum contribution margin The same raw material is used in all three products. Barlow Company has only 6.000 pounds of raw material on hand and will not h able to obtain any more of it for several weeks due to a strike in its supplier's plant. Management is trying to decide which products concentrate on next week in filling its backlog of orders. The material costs $8 per pound. Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2. Assuming that Barlow has unlimited demand for each of its three products, whot is the maximum contribution margin the compar can earn when using the 6.000 pounds of raw material on hand? 3. Assuming that Barlow's estimated customer demand is 500 units per product line, what is the maximum contribution margin the company can earn when using the 6,000 pounds of raw material on hand? 4. A foreign supplier could furnish Barlow with additional stocks of the raw material at a substantial premium over the usual price: Assuming Barlow's estimated customer demand is 500 units per product line and that the company has used its 6,000 pounds ofr material in an optimal fashion. what is the highest price Barlow Company should be willing to pay for an additional pound of materi Complete this question by entering your answers in the tabs below. A foreign supplier could furnish Barlow with additional stocks of the raw material at a substantial premium over the usual price. Assuming Barlow's estimated customer demand is 500 units per product line and that the company has used its 6,000 pounds of raw material in an optimal fashion, what is the highest price Barlow Company should be willing to pay for an additional pound of materials? Exercise 11-9 (Static) Special Order Decision [LO11-4] Delta Company produces a single product. The cost of producing and selling a single unit of this product at the compony's normal house for 15,000 units ot a special price of $1400. The company s copown, 000 units per year, An order has been received from a malliorder. Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate mottet from the special order, ossume the compony's inventory includes 1.000 units of this product that were. Complete this question by entering your answers in the tabs below. Exercise 11-9 (Static) Special Order Decision [LO11-4] Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 60.000 units per year is: The normal selling price is $21 per unit. The company's copacity is 75.000 units per yeor. An order has been recelved from o mol-ordehouse for 15,000 units at a special price of $14.00 per unit. This order would not atfect regular soles or the company's toeal fixed costs Required: 1. What is the financial advontage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's inventory includes 1,000 units of this product that were produced last year and that are inferior to the curtent model. The units must be sold through regular channels at reduced prices. The company does not expect the selling of these inferior units to have any affect on the sales of its current model What unit cost is relevant for establishing a minimum selling price for the inferior units? Complete this question by entering your answers in the tabs below. As a separate matter from the spedal order, assume the company's inventory indudes 1,000 units of this product that were. produced last year and that are inferior to the current mode. The units must be sold through reoular channels at reduced What unit cost is relevant for estabibhing a minimum telling price for the inferior units? (flound your answer to 2 dedimal. Exercise 11-10 (Static) Make or Buy Decision [LO11-3] Futura Company purchases the 40,000 startert that it installs in its standard line of farm tractors from a supplier for the price of 58.40 per unit. Due to a reducton in output, the company now hos idle copocity thot could be used to produce the starters rather than mivina them from an outside supplier. Howevec, the company's chief engineer is opposed to moking the stacters because the is based on space uthized in the plant. The totel rent on the plant is $80.000 pet period. Depreciation is due to obcolescence rat eses than wear and teor. Required: What is the financial advantoge fdisadvantege) of making the 40,000 starters instead of buying them from an autside supplet? Exercise 11-17 (Static) Dropping or Retaining a Segment [L.O11-2] Bed \& Bath, a retalling company, has two deporments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: A study indicates that $340,000 of the fixed expenses being charged to Linens are surik cusu in wlocoted costs that will continue even if the Linens Department is dropped. In addition, the eliminotion of the Linens Department will result in a 10% decrease in the sales of the Hardware Deportment. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts