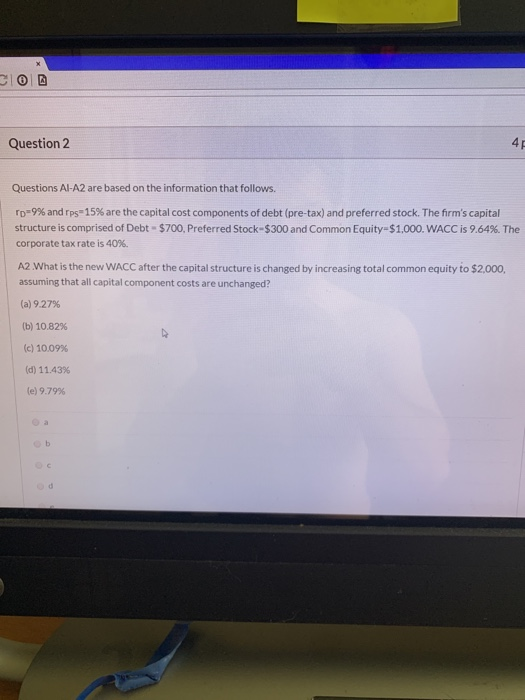

Question: Question 2 Questions Al-A2 are based on the information that follows. Tp-9% and rps-15% are the capital cost components of debt (pre-tax) and preferred stock.

Question 2 Questions Al-A2 are based on the information that follows. Tp-9% and rps-15% are the capital cost components of debt (pre-tax) and preferred stock. The firm's capital structure is comprised of Debt - $700. Preferred Stock-$300 and Common Equity=$1,000. WACC is 9.64%. The corporate tax rate is 40%. A2 What is the new WACC after the capital structure is changed by increasing total common equity to $2,000, assuming that all capital component costs are unchanged? (a) 9.27% (b) 10.82% (c) 10.09% (d) 11.43% le) 9.79%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock