Question: Question 2 Read the scenario below and answer the question that follows: You are the financial manager of a firm that wants an evaluation

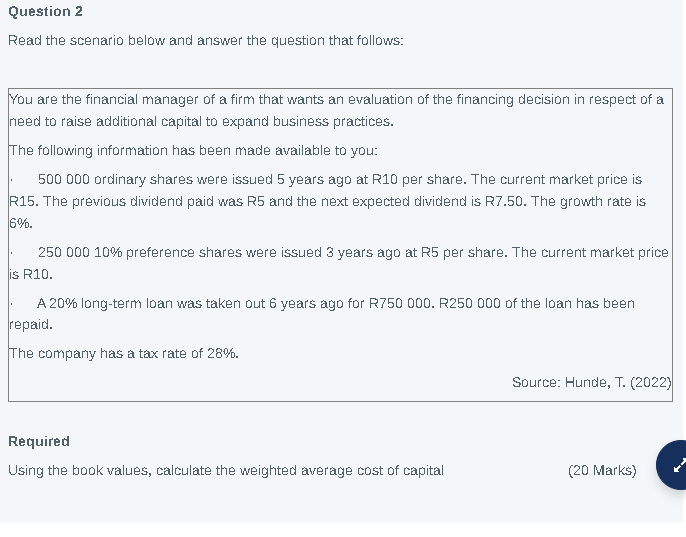

Question 2 Read the scenario below and answer the question that follows: You are the financial manager of a firm that wants an evaluation of the financing decision in respect of a need to raise additional capital to expand business practices. The following information has been made available to you: 500 000 ordinary shares were issued 5 years ago at R10 per share. The current market price is R15. The previous dividend paid was R5 and the next expected dividend is R7.50. The growth rate is 6%. 250 000 10% preference shares were issued 3 years ago at R5 per share. The current market price is R10. A 20% long-term loan was taken out 6 years ago for R750 000. R250 000 of the loan has been repaid. The company has a tax rate of 28%. Required Source: Hunde, T. (2022) Using the book values, calculate the weighted average cost of capital (20 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts