Question: Question 2 Required: (a) Post the two general journal entries below to the general ledger accounts below. (b) Determine that carrying amount of the Machinery

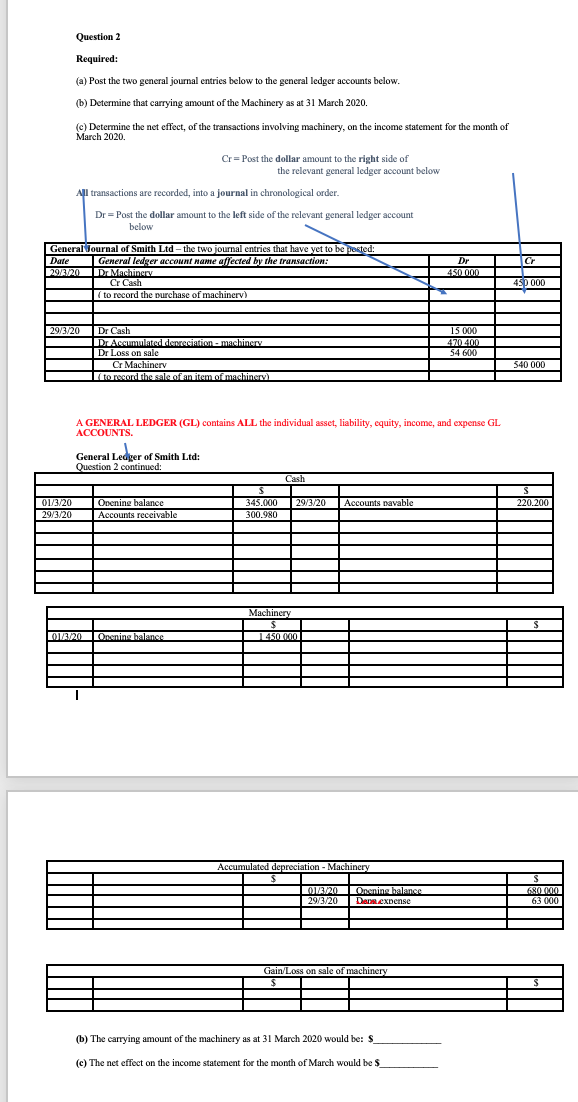

Question 2 Required: (a) Post the two general journal entries below to the general ledger accounts below. (b) Determine that carrying amount of the Machinery as at 31 March 2020. (c) Determine the net effect of the transactions involving machinery, on the income statement for the month of March 2020. Cr= Post the dollar amount to the right side of the relevant general ledger account below All transactions are recorded into a journal in chronological order. Dr Post the dollar amount to the left side of the relevant general ledger account below General Journal of Smith Ltd - the two journal entries that have yet to be posted: Date General ledger account name affected by the transaction: 2014120 Dr Machinery Cr Cash (to record the purchase of machinery) 450 000 45 000 29/3/20 Dr Cash Dr Accumulated detection machinery Dr Loss on sale Cr Machinery Il to record the sale of an item of machinery 15 000 470 400 54 ) 540 000 A GENERAL LEDGER (GL) contains ALL the individual asset, liability, equity, income, and expense GL ACCOUNTS. General Ledger of Smith Ltd: Question 2 continued Cash 29/3/20 Accounts pavable 220.200 01/3/20 29/3/20 | Onenine balance Accounts receivable 345.000 300.980 Machinery Opening balance 1 450 000 Accumulated depreciation - Machinery 01/3/20 29/3/20 Opening balance Dans.expense 680 000 63 000 Gain/Loss on sale of machinery (b) The carrying amount of the machinery as at 31 March 2020 would be: $ (e) The net effect on the income statement for the month of March would be 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts