Question: Question 2 - Reserve Requirements Consider the 3 generations OLG economy seen in class. Utility function is given by: u(C1,1,C2,1,C3,t) = log(C1,t) + log(C2,t) +

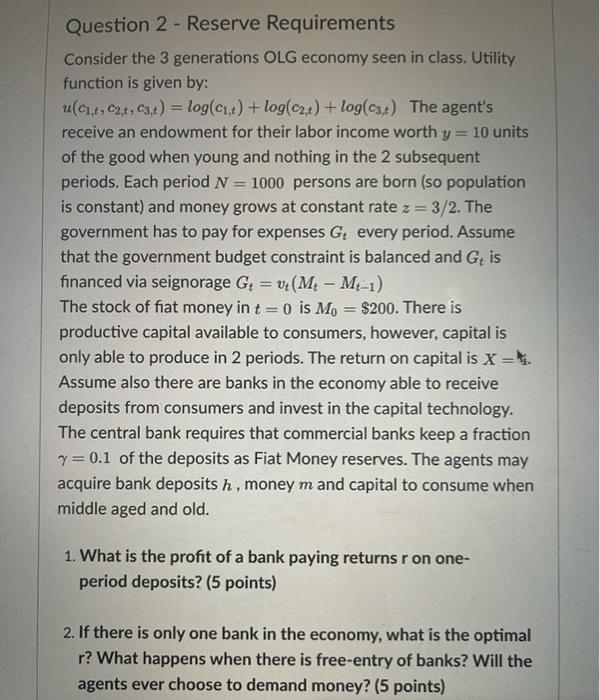

Question 2 - Reserve Requirements Consider the 3 generations OLG economy seen in class. Utility function is given by: u(C1,1,C2,1,C3,t) = log(C1,t) + log(C2,t) + log(C3,t) The agent's receive an endowment for their labor income worth y = 10 units of the good when young and nothing in the 2 subsequent periods. Each period N = 1000 persons are born (so population is constant) and money grows at constant rate z= 3/2. The government has to pay for expenses Gt every period. Assume that the government budget constraint is balanced and Gt is financed via seignorage G4 = v:(M - Mt-1) The stock of fiat money in t=0 is Mo = $200. There is productive capital available to consumers, however, capital is only able to produce in 2 periods. The return on capital is x = s. Assume also there are banks in the economy able to receive deposits from consumers and invest in the capital technology. The central bank requires that commercial banks keep a fraction y = 0.1 of the deposits as Fiat Money reserves. The agents may acquire bank deposits h . money m and capital to consume when middle aged and old. 1. What is the profit of a bank paying returns r on one- period deposits? (5 points) 2. If there is only one bank in the economy, what is the optimal r? What happens when there is free-entry of banks? Will the agents ever choose to demand money? (5 points) Question 2 - Reserve Requirements Consider the 3 generations OLG economy seen in class. Utility function is given by: u(C1,1,C2,1,C3,t) = log(C1,t) + log(C2,t) + log(C3,t) The agent's receive an endowment for their labor income worth y = 10 units of the good when young and nothing in the 2 subsequent periods. Each period N = 1000 persons are born (so population is constant) and money grows at constant rate z= 3/2. The government has to pay for expenses Gt every period. Assume that the government budget constraint is balanced and Gt is financed via seignorage G4 = v:(M - Mt-1) The stock of fiat money in t=0 is Mo = $200. There is productive capital available to consumers, however, capital is only able to produce in 2 periods. The return on capital is x = s. Assume also there are banks in the economy able to receive deposits from consumers and invest in the capital technology. The central bank requires that commercial banks keep a fraction y = 0.1 of the deposits as Fiat Money reserves. The agents may acquire bank deposits h . money m and capital to consume when middle aged and old. 1. What is the profit of a bank paying returns r on one- period deposits? (5 points) 2. If there is only one bank in the economy, what is the optimal r? What happens when there is free-entry of banks? Will the agents ever choose to demand money? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts