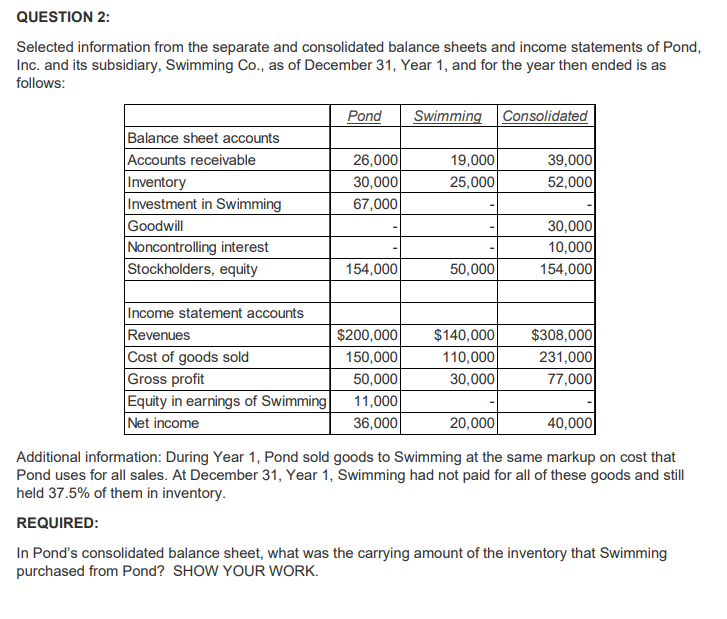

Question: QUESTION 2 : Selected information from the separate and consolidated balance sheets and income statements of Pond, Inc. and its subsidiary, Swimming Co . ,

QUESTION :

Selected information from the separate and consolidated balance sheets and income statements of Pond, Inc. and its subsidiary, Swimming Co as of December Year and for the year then ended is as follows:

tablePond,Swimming,ConsolidatedBalance sheet accounts,,,Accounts receivable,InventoryInvestment in Swimming,GoodwillNoncontrolling interest,Stockholders equity,Income statement accounts,,,Revenues$$$Cost of goods sold,Gross profit,Equity in earnings of Swimming,Net income,

Additional information: During Year Pond sold goods to Swimming at the same markup on cost that Pond uses for all sales. At December Year Swimming had not paid for all of these goods and still held of them in inventory.

REQUIRED:

In Pond's consolidated balance sheet, what was the carrying amount of the inventory that Swimming purchased from Pond? SHOW YOUR WORK.Parrot Inc. owns of Seal Cos outstanding common shares. The carrying value of Seal's

equity is $ Seal subsequently issues an additional previously unissued shares for $

to an outside party that is unrelated to either Parrot or Seal.

REQUIRED:

What is the total noncontrolling interest after the additional shares are issued? SHOW YOUR WORK.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock