Question: Question 2 Seller s Perspective - Answer to be placed on page 2 answer sheet - The Seller of the property is having second thoughts

Question Sellers Perspective Answer to be placed on page answer sheet The Seller of the property is having second thoughts about selling even though the Seller got a good deal years ago. The full straightline depreciation allowance has been taken every year. Use the Ch excel you might have to modify to calculate the ATCF from the sale. You are using this sheet to look at what the Seller has actually made the last years. HERE IS THE PROPERTY DESCRIPTION:

PLEASE WORK ON THIS PROPERTY:

Roseland Ave, Dallas, TX

Show on Map

Date Added:

November

Days on Market:

days

Time Since Last Update:

days

Details:

Property Type: Multifamily

Subtype: Apartment Building

Investment Type: Core

Class: A

Square Footage:

Occupancy:

ProForma NOI: $

Units:

Year Built:

Buildings:

Stories:

Zoning: MF

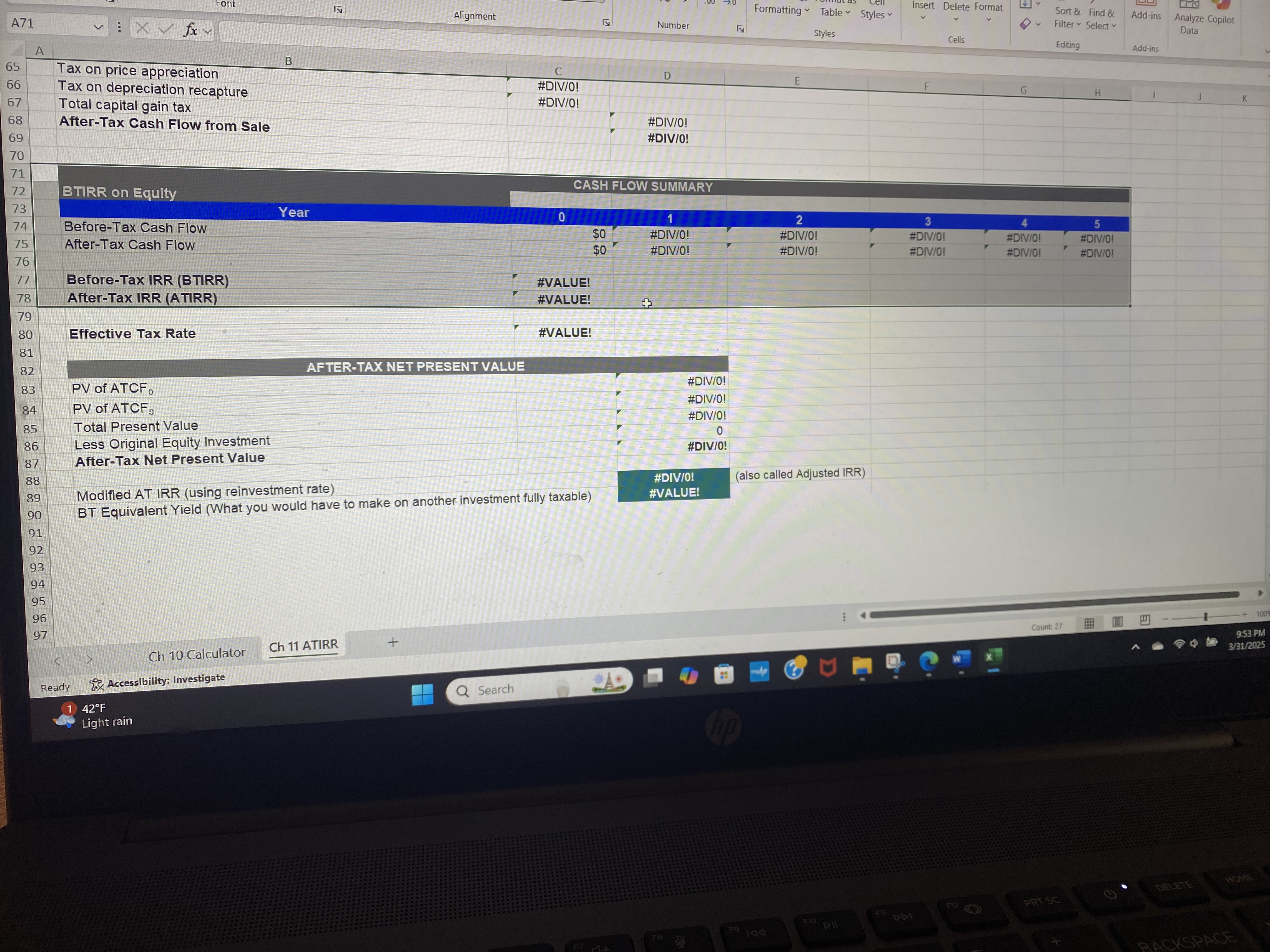

Part A Paste screenshot of your excel calculations of the complete Aftertax cash flow from sale in year with ATCF and ATIRR probably A through CEXCEL SHEET IS:

CASH FLOW SUMMARY

BTIRR on Equity

Year

BeforeTax Cash Flow

$

AfterTax Cash Flow

$

BeforeTax IRR BTIRR

#VALUE!

AfterTax IRR ATIRR

#VALUE!

Effective Tax Rate

#VALUE!

Part B List of the selling assumptions that might be different in real life compared to the assumptions for your found property.

Part C Explain for each one, how that difference impacts your calculation of ATCF and in turn the Sellers decision making.

SELLING ASSUMPTIONS for Part A

Sales Price today Listed Price online

Purchase Price years ago of Sales Price today

st year Total Annual Rent of years ago Purchase Price

Rent Growth

Vacancy

Operating Expenses

Annual Appreciation the past years for the multifamily market

Original Purchase Price Original Cost Basis

Building of Total Deal

Original Loan year, LTV @

Equity Discount Rate

Reinvestment Rate

Selling Costs

Capital Gains Tax Rate

Income Tax Bracket

Depreciation Recapture Rate

PLEASE USE THE BELOWPROVIDED EXCEL SHEET probably A through C AND WRITE DETAILS ON HOW TO DO THAT CALCULATION ON MY EXCEL SHEET.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock