Question: Question 2: Senso ple plans to make a bid for the entire share capital of Enco pic. a company in a different industry. It is

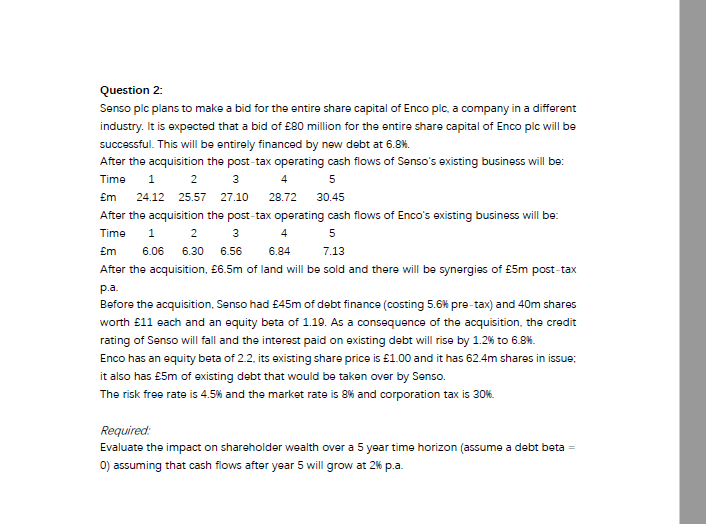

Question 2: Senso ple plans to make a bid for the entire share capital of Enco pic. a company in a different industry. It is expected that a bid of $80 million for the entire share capital of Enco pic will be successful. This will be entirely financed by new debt at 6.8K. After the acquisition the post-tax operating cash flows of Senso's existing business will be: Time 1 2 3 4 5 Em 24.12 25.57 27.10 28.72 30.45 After the acquisition the post-tax operating cash flows of Enco's existing business will be: Time 1 2 3 4 5 Em 6.06 6.30 6.56 6.84 7.13 After the acquisition, $6.5m of land will be sold and there will be synergies of $5m post-tax p.a. Before the acquisition, Senso had $45m of debt finance (costing 5.6k pre-tax) and 40m shares worth $11 each and an equity beta of 1.19. As a consequence of the acquisition, the credit rating of Senso will fall and the interest paid on existing debt will rise by 1.2% to 6.8K. Enco has an equity beta of 2.2. its existing share price is $1.00 and it has 62 4m shares in issue; it also has $5m of existing debt that would be taken over by Senso. The risk free rate is 4.5% and the market rate is 8% and corporation tax is 30k. Required: Evaluate the impact on shareholder wealth over a 5 year time horizon (assume a debt beta = 0) assuming that cash flows after year 5 will grow at 21 p.a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts