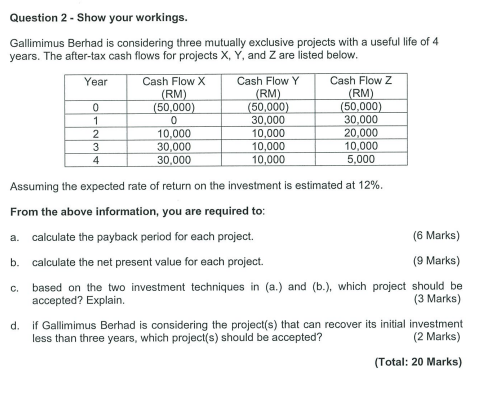

Question: Question 2 - Show your workings. Gallimimus Berhad is considering three mutually exclusive projects with a useful life of 4 years. The after-tax cash flows

Question 2 - Show your workings. Gallimimus Berhad is considering three mutually exclusive projects with a useful life of 4 years. The after-tax cash flows for projects \\( X, Y \\), and \\( Z \\) are listed below. Assuming the expected rate of return on the investment is estimated at \12. From the above information, you are required to: a. calculate the payback period for each project. (6 Marks) b. calculate the net present value for each project. (9 Marks) c. based on the two investment techniques in (a.) and (b.), which project should be accepted? Explain. (3 Marks) d. if Gallimimus Berhad is considering the project(s) that can recover its initial investment less than three years, which project(s) should be accepted? (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts