Question: Question 2. Small Town Sweets-audit planning analytics (4%) Small Town Sweets is based in Molong, NSW, and produces a range of high-quality confectionery for the

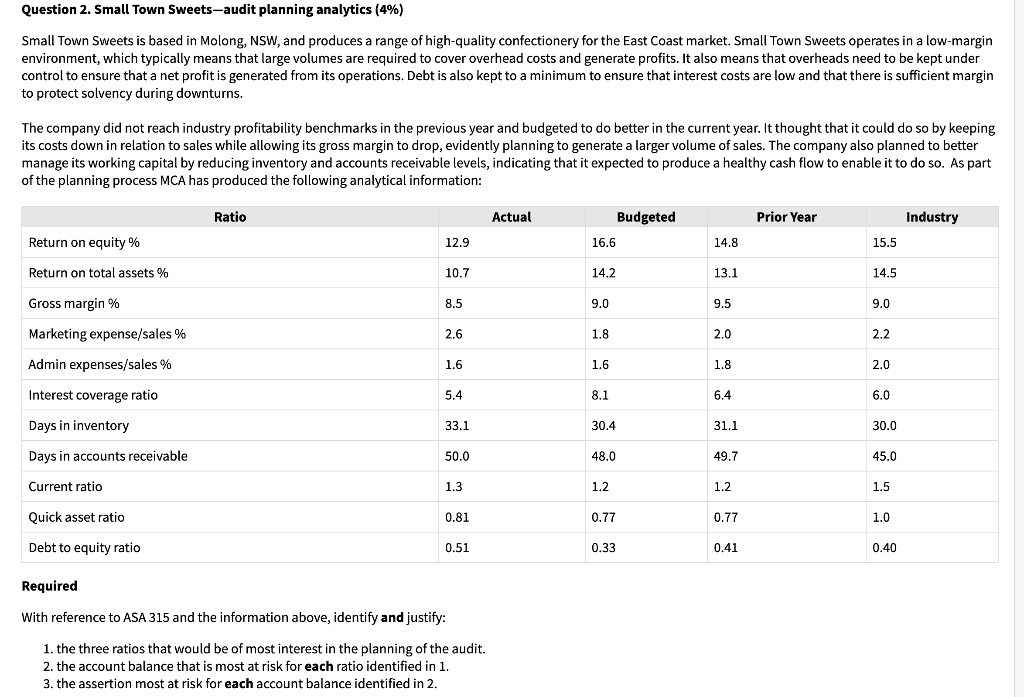

Question 2. Small Town Sweets-audit planning analytics (4%) Small Town Sweets is based in Molong, NSW, and produces a range of high-quality confectionery for the East Coast market. Small Town Sweets operates in a low-margin environment, which typically means that large volumes are required to cover overhead costs and generate profits. It also means that overheads need to be kept under control to ensure that a net profit is generated from its operations. Debt is also kept to a minimum to ensure that interest costs are low and that there is sufficient margin to protect solvency during downturns. The company did not reach industry profitability benchmarks in the previous year and budgeted to do better in the current year. It thought that it could do so by keeping its costs down in relation to sales while allowing its gross margin to drop, evidently planning to generate a larger volume of sales. The company also planned to better manage its working capital by reducing inventory and accounts receivable levels, indicating that it expected to produce a healthy cash flow to enable it to do so. As part of the planning process MCA has produced the following analytical information: Ratio Actual Budgeted Prior Year Industry Return on equity % 12.9 14.8 15.5 Return on total assets% 10.7 13.1 14.5 Gross margin % 8.5 9.5 9.0 Marketing expense/sales % 2.6 2.0 2.2 Admin expenses/sales% 1.6 1.8 2.0 Interest coverage ratio 5.4 6.4 6.0 Days in inventory 33.1 31.1 30.0 Days in accounts receivable 50.0 49.7 45.0 Current ratio 1.3 1.2 1.5 Quick asset ratio 0.81 0.77 1.0 Debt to equity ratio 0.51 0.41 0.40 Required With reference to ASA 315 and the information above, identify and justify: 1. the three ratios that would be of most interest in the planning of the audit. 2. the account balance that is most at risk for each ratio identified in 1. 3. the assertion most at risk for each account balance identified in 2. 16.6 14.2 9.0 1.8 1.6 8.1 30.4 48.0 1.2 0.77 0.33 Question 2. Small Town Sweets-audit planning analytics (4%) Small Town Sweets is based in Molong, NSW, and produces a range of high-quality confectionery for the East Coast market. Small Town Sweets operates in a low-margin environment, which typically means that large volumes are required to cover overhead costs and generate profits. It also means that overheads need to be kept under control to ensure that a net profit is generated from its operations. Debt is also kept to a minimum to ensure that interest costs are low and that there is sufficient margin to protect solvency during downturns. The company did not reach industry profitability benchmarks in the previous year and budgeted to do better in the current year. It thought that it could do so by keeping its costs down in relation to sales while allowing its gross margin to drop, evidently planning to generate a larger volume of sales. The company also planned to better manage its working capital by reducing inventory and accounts receivable levels, indicating that it expected to produce a healthy cash flow to enable it to do so. As part of the planning process MCA has produced the following analytical information: Ratio Actual Budgeted Prior Year Industry Return on equity % 12.9 14.8 15.5 Return on total assets% 10.7 13.1 14.5 Gross margin % 8.5 9.5 9.0 Marketing expense/sales % 2.6 2.0 2.2 Admin expenses/sales% 1.6 1.8 2.0 Interest coverage ratio 5.4 6.4 6.0 Days in inventory 33.1 31.1 30.0 Days in accounts receivable 50.0 49.7 45.0 Current ratio 1.3 1.2 1.5 Quick asset ratio 0.81 0.77 1.0 Debt to equity ratio 0.51 0.41 0.40 Required With reference to ASA 315 and the information above, identify and justify: 1. the three ratios that would be of most interest in the planning of the audit. 2. the account balance that is most at risk for each ratio identified in 1. 3. the assertion most at risk for each account balance identified in 2. 16.6 14.2 9.0 1.8 1.6 8.1 30.4 48.0 1.2 0.77 0.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts