Question: QUESTION 2 SolarWheels Limited ( ' SW ' ) is a South African company specialising in the sale of ecofriendly electric vehicles and scooters. SW

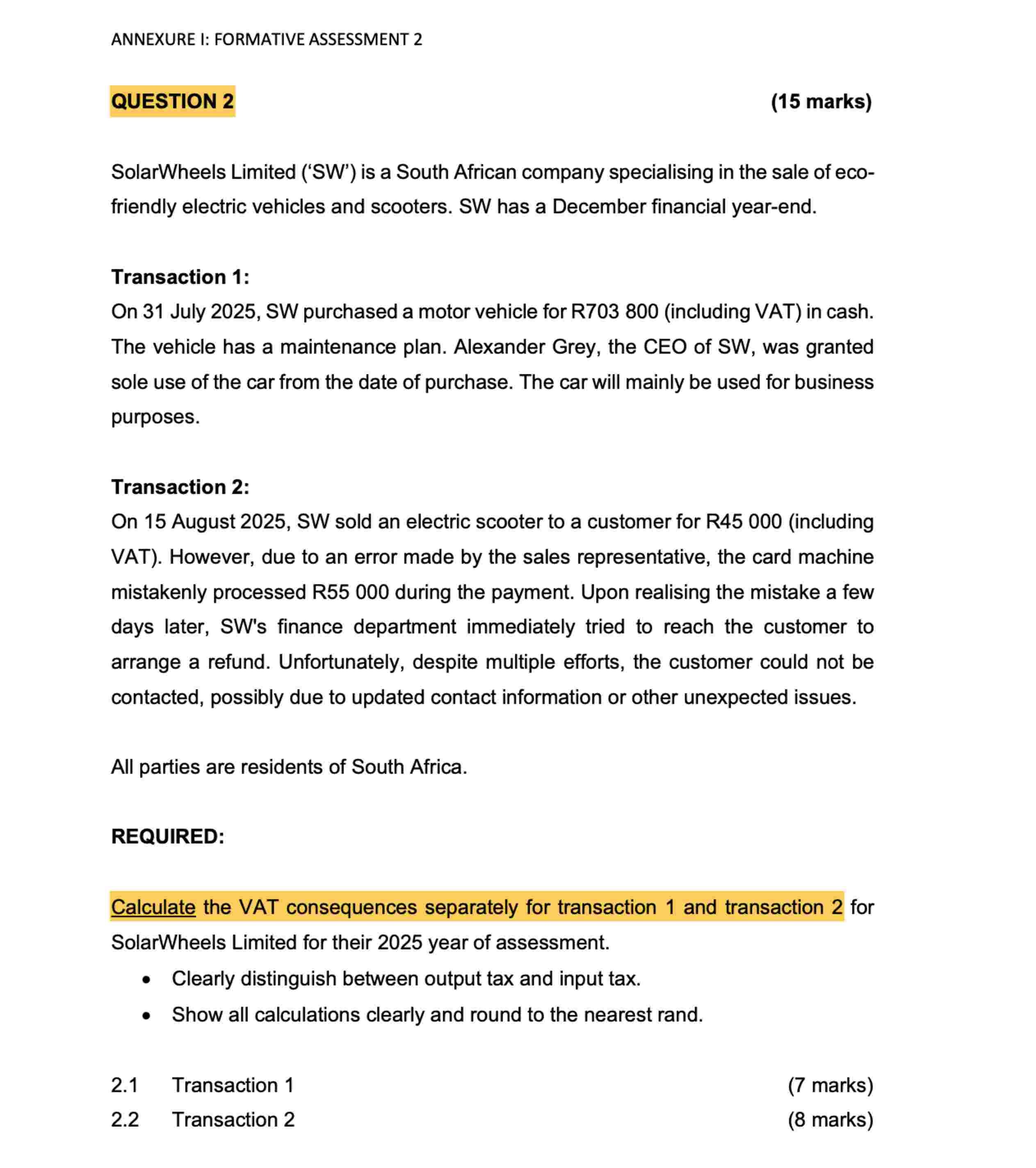

QUESTION SolarWheels Limited SW is a South African company specialising in the sale of ecofriendly electric vehicles and scooters. SW has a December financial yearend. Transaction : On July SW purchased a motor vehicle for Rincluding VAT in cash. The vehicle has a maintenance plan. Alexander Grey, the CEO of SW was granted sole use of the car from the date of purchase. The car will mainly be used for business purposes. Transaction : On August SW sold an electric scooter to a customer for Rincluding VAT However, due to an error made by the sales representative, the card machine mistakenly processed R during the payment. Upon realising the mistake a few days later, SWs finance department immediately tried to reach the customer to arrange a refund. Unfortunately, despite multiple efforts, the customer could not be contacted, possibly due to updated contact information or other unexpected issues. All parties are residents of South Africa. REQUIRED: Calculate the VAT consequences separately for transaction and transaction for SolarWheels Limited for their year of assessment. Clearly distinguish between output tax and input tax. Show all calculations clearly and round to the nearest rand. Transaction Transaction

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock