Question: QUESTION 2 Study the information provided below and answer the following questions. Stevmark Limited manufactures precision tools to its customers' own specifications. The manufacturing operations

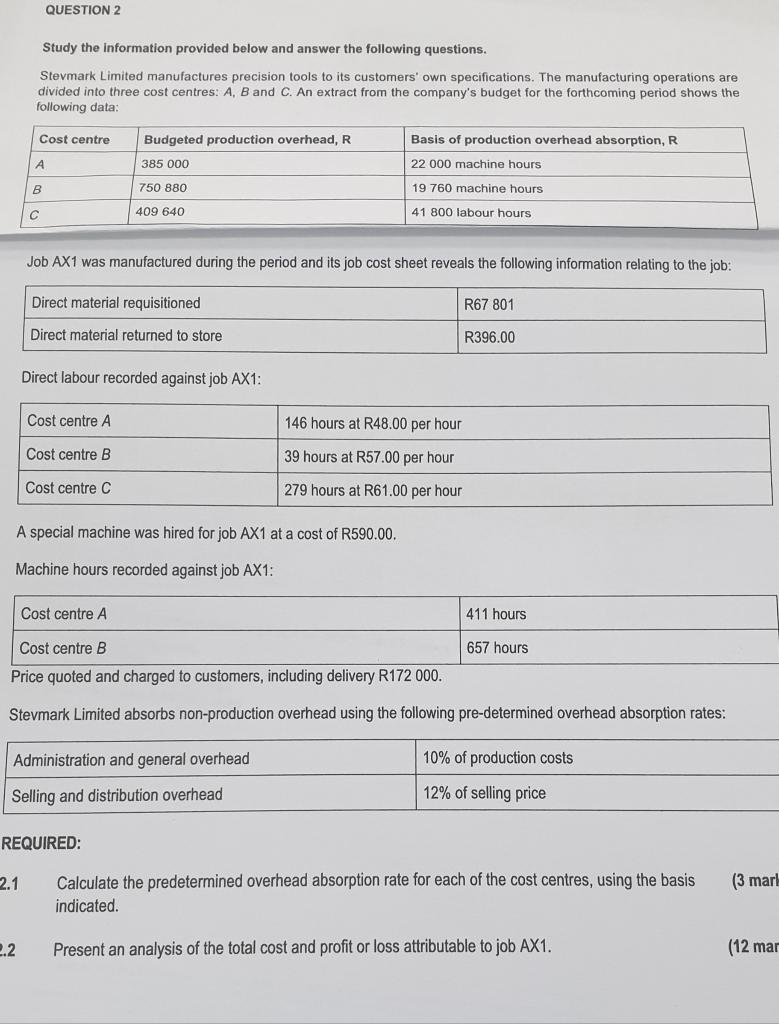

QUESTION 2 Study the information provided below and answer the following questions. Stevmark Limited manufactures precision tools to its customers' own specifications. The manufacturing operations are divided into three cost centres: A,B and C. An extract from the company's budget for the forthcoming period shows the following data: Job AX1 was manufactured during the period and its job cost sheet reveals the following information relating to the job: Direct labour recorded against job AX1 : A special machine was hired for job AX1 at a cost of R590.00. Machine hours recorded against job AX1: Price quoted and charged to customers, including delivery R172 000. Stevmark Limited absorbs non-production overhead using the following pre-determined overhead absorption rates: REQUIRED: 2.1 Calculate the predetermined overhead absorption rate for each of the cost centres, using the basis (3mar indicated. Present an analysis of the total cost and profit or loss attributable to job AX1. (12ma

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts