Question: Question 2 Study the scenario below and answer the questions that follow: Star Ltd (Star) Star Ltd (Star) is considering the acquisition of a competitor

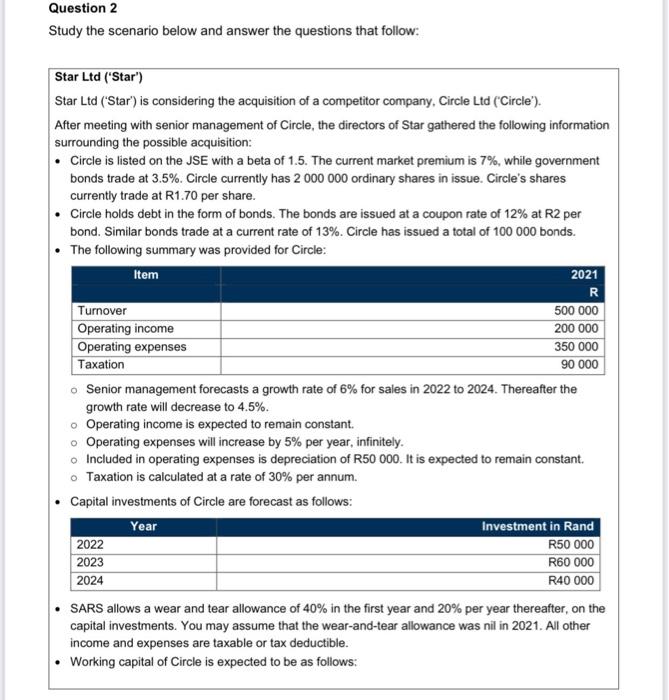

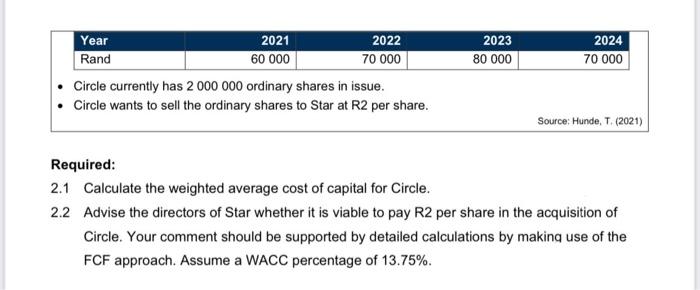

Question 2 Study the scenario below and answer the questions that follow: Star Ltd ("Star") Star Ltd ("Star") is considering the acquisition of a competitor company, Circle Ltd (Circle). After meeting with senior management of Circle, the directors of Star gathered the following information surrounding the possible acquisition: Circle is listed on the JSE with a beta of 1.5. The current market premium is 7%, while government bonds trade at 3.5%. Circle currently has 2 000 000 ordinary shares in issue. Circle's shares currently trade at R1.70 per share. Circle holds debt in the form of bonds. The bonds are issued at a coupon rate of 12% at R2 per bond. Similar bonds trade at a current rate of 13%. Circle has issued a total of 100 000 bonds. The following summary was provided for Circle: Item 2021 R Turnover 500 000 Operating income 200 000 Operating expenses 350 000 Taxation 90 000 o Senior management forecasts a growth rate of 6% for sales in 2022 to 2024. Thereafter the growth rate will decrease to 4.5%. o Operating income is expected to remain constant. Operating expenses will increase by 5% per year, infinitely. Included in operating expenses is depreciation of R50 000. It is expected to remain constant. Taxation is calculated at a rate of 30% per annum. Capital investments of Circle are forecast as follows: Year Investment in Rand 2022 R50 000 2023 R60 000 2024 R40 000 SARS allows a wear and tear allowance of 40% in the first year and 20% per year thereafter, on the capital investments. You may assume that the wear-and-tear allowance was nil in 2021. All other income and expenses are taxable or tax deductible. Working capital of Circle is expected to be as follows: 2023 80 000 2024 70 000 Year 2021 2022 Rand 60 000 70 000 Circle currently has 2 000 000 ordinary shares in issue. Circle wants to sell the ordinary shares to Star at R2 per share. Source: Hunde, T. (2021) Required: 2.1 Calculate the weighted average cost of capital for Circle. 2.2 Advise the directors of Star whether it is viable to pay R2 per share in the acquisition of Circle. Your comment should be supported by detailed calculations by making use of the FCF approach. Assume a WACC percentage of 13.75%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts