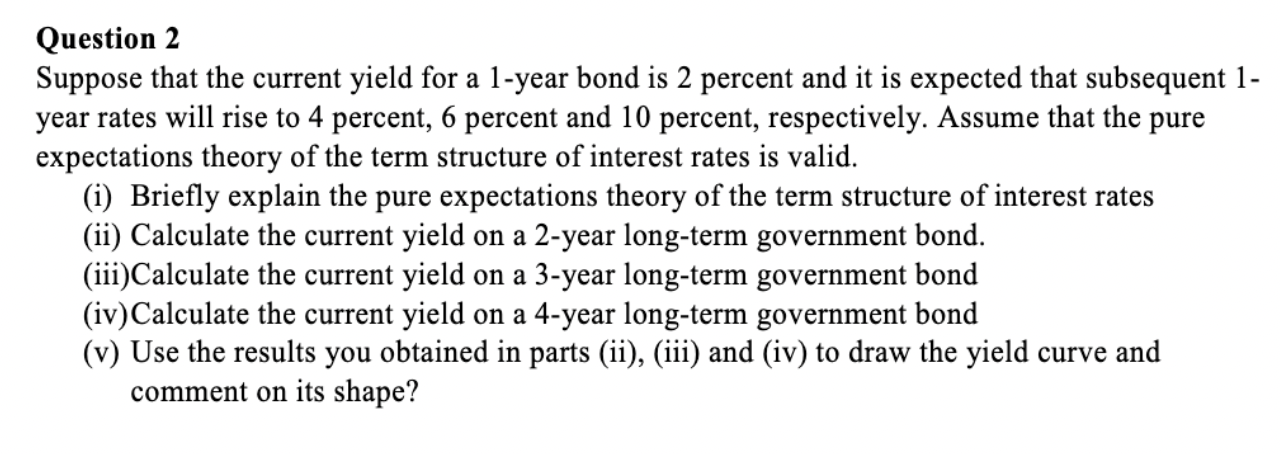

Question: Question 2 Suppose that the current yield for a 1 - year bond is 2 percent and it is expected that subsequent 1 - year

Question

Suppose that the current yield for a year bond is percent and it is expected that subsequent

year rates will rise to percent, percent and percent, respectively. Assume that the pure

expectations theory of the term structure of interest rates is valid.

i Briefly explain the pure expectations theory of the term structure of interest rates

ii Calculate the current yield on a year longterm government bond.

iiiCalculate the current yield on a year longterm government bond

ivCalculate the current yield on a year longterm government bond

v Use the results you obtained in parts iiiii and iv to draw the yield curve and

comment on its shape?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock