Question: Question 2 Swoon was founded on 1 January 2014 when its owner paid 80,000 into the business as share capital. The retail price index

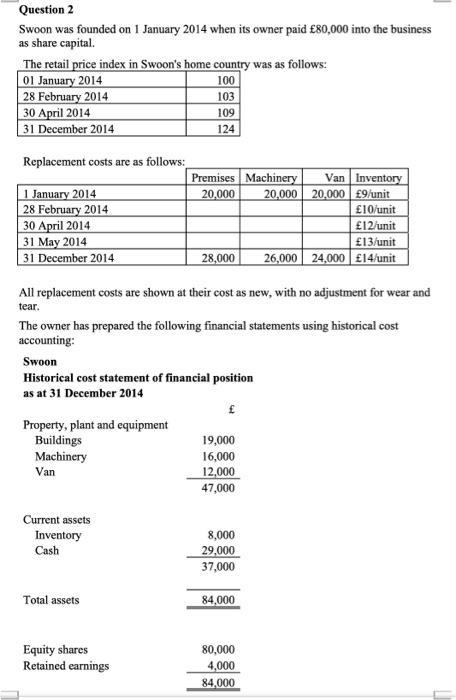

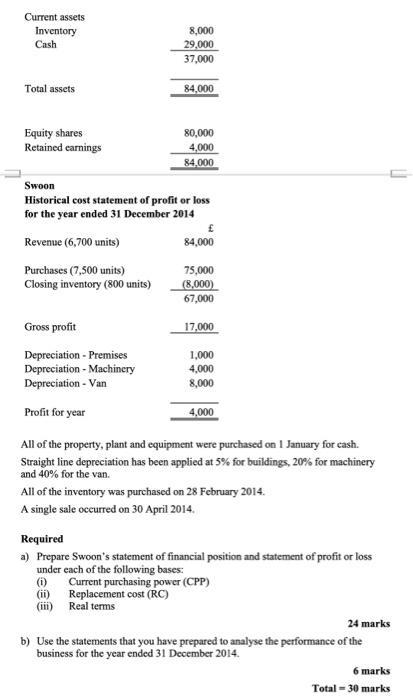

Question 2 Swoon was founded on 1 January 2014 when its owner paid 80,000 into the business as share capital. The retail price index in Swoon's home country was as follows: 01 January 2014 28 February 2014 30 April 2014 31 December 2014 100 103 109 124 Replacement costs are as follows: Premises Machinery Van Inventory 20,000 20,000 9/unit 10/unit 1 January 2014 28 February 2014 30 April 2014 31 May 2014 31 December 2014 20,000 12/unit 13/unit 28,000 26,000 24,000 14/unit All replacement costs are shown at their cost as new, with no adjustment for wear and tear. The owner has prepared the following financial statements using historical cost accounting: Swoon Historical cost statement of financial position as at 31 December 2014 Property, plant and equipment Buildings Machinery 19,000 16,000 12,000 47,000 Van Current assets Inventory 8,000 Cash 29,000 37,000 Total assets 84,000 Equity shares Retained carnings 80,000 4,000 84,000 Current assets Inventory Cash 8,000 29,000 37,000 Total assets 84,000 Equity shares Retained earnings 80,000 4,000 84,000 Swoon Historical cost statement of profit or loss for the year ended 31 December 2014 Revenue (6,700 units) 84,000 Purchases (7,500 units) Closing inventory (800 units) 75,000 (8,000) 67,000 Gross profit 17,000 Depreciation - Premises Depreciation - Machinery Depreciation - Van 1,000 4,000 8,000 Profit for year 4,000 All of the property, plant and equipment were purchased on 1 January for cash. Straight line depreciation has been applied at 5% for buildings, 20% for machinery and 40% for the van. All of the inventory was purchased on 28 February 2014. A single sale occurred on 30 April 2014. Required a) Prepare Swoon's statement of financial position and statement of profit or loss under each of the following bases: (i) Current purchasing power (CPP) (ii) Replacement cost (RC) (iii) Real terms 24 marks b) Use the statements that you have prepared to analyse the performance of the business for the year ended 31 December 2014. 6 marks Total - 30 marks

Step by Step Solution

3.55 Rating (169 Votes )

There are 3 Steps involved in it

aSwoon Current Purchasing Power CPP Statement of Financial Position As at 31 December 2014 Property Plant and Equipment Buildings Machinery Van 19000 ... View full answer

Get step-by-step solutions from verified subject matter experts