Question: QUESTION 2 Tech Co is considering a new project proposed by its marketing department following market research, the four-year project is expected to generate revenue

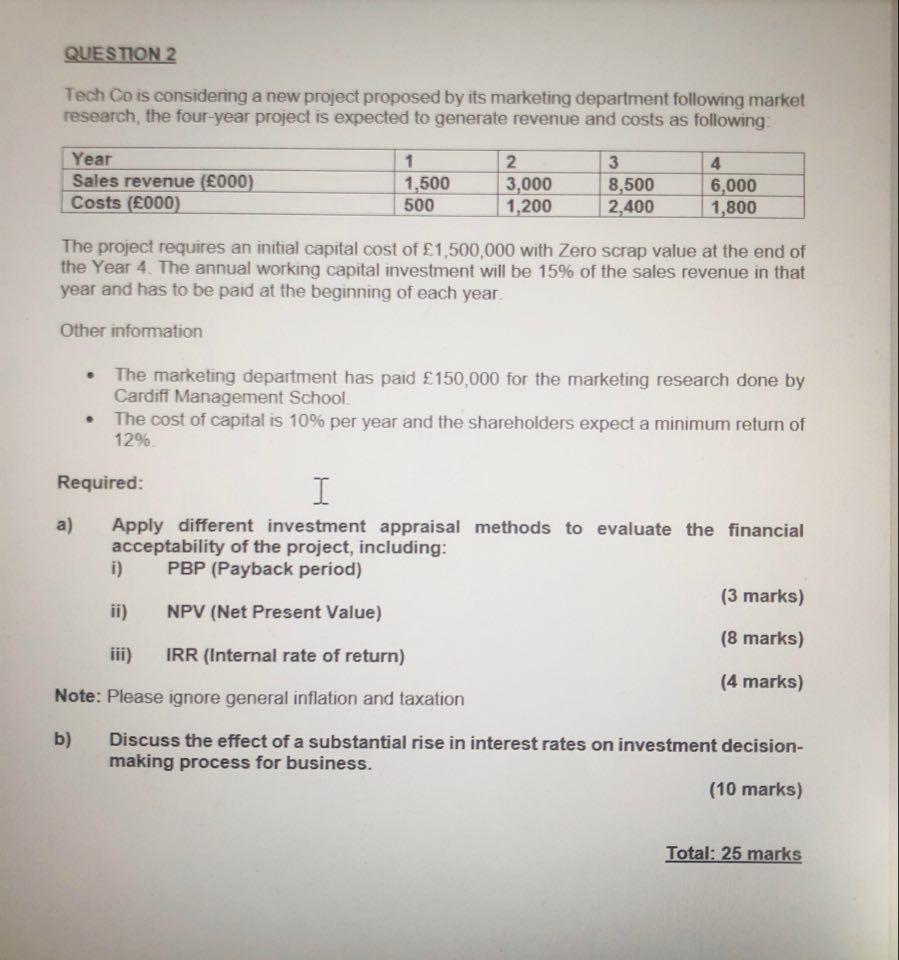

QUESTION 2 Tech Co is considering a new project proposed by its marketing department following market research, the four-year project is expected to generate revenue and costs as following Year Sales revenue (000) Costs (000) 1 1,500 500 2 3,000 1,200 3 8,500 2,400 4 6,000 1,800 The project requires an initial capital cost of 1,500,000 with Zero scrap value at the end of the Year 4. The annual working capital investment will be 15% of the sales revenue in that year and has to be paid at the beginning of each year. Other information The marketing department has paid 150,000 for the marketing research done by Cardiff Management School. The cost of capital is 10% per year and the shareholders expect a minimum retum of 12% Required: I a) Apply different investment appraisal methods to evaluate the financial acceptability of the project, including: i) PBP (Payback period) (3 marks) ii) NPV (Net Present Value) (8 marks) iii) IRR (Internal rate of return) (4 marks) Note: Please ignore general inflation and taxation b) Discuss the effect of a substantial rise in interest rates on investment decision- making process for business. (10 marks) Total: 25 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts