Question: Question 2 The beta coefficient for Stock C is Bc 1.2, while that for Stock D is B0.3. (Stock D's beta is negative, indicating that

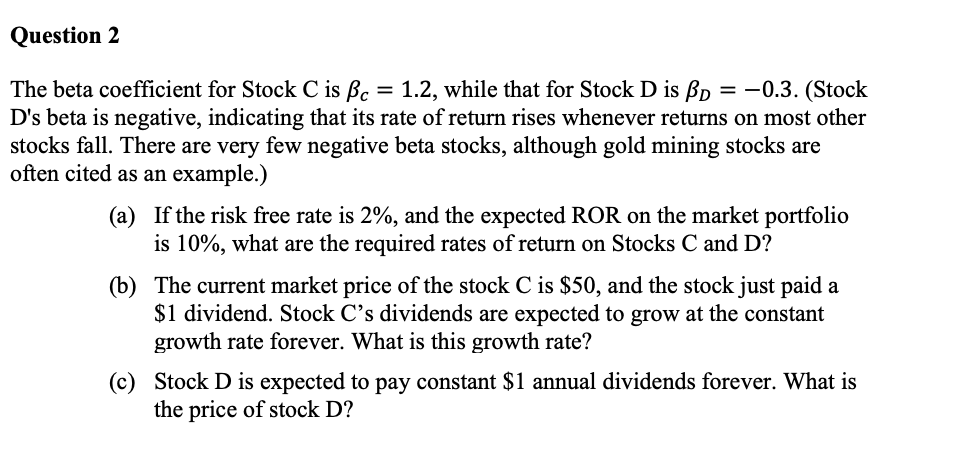

Question 2 The beta coefficient for Stock C is Bc 1.2, while that for Stock D is B0.3. (Stock D's beta is negative, indicating that its rate of return rises whenever returns on most other stocks fall. There are very few negative beta stocks, although gold mining stocks are often cited as an example.) (a) If the risk free rate is 2%, and the expected ROR on the market portfolio is 10%, what are the required rates of return on Stocks C and D? (b) The current market price of the stock C is $50, and the stock just paid a $1 dividend. Stock C's dividends are expected to grow at the constant growth rate forever. What is this growth rate? (c) Stock D is expected to pay constant $1 annual dividends forever. What is the price of stock D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts