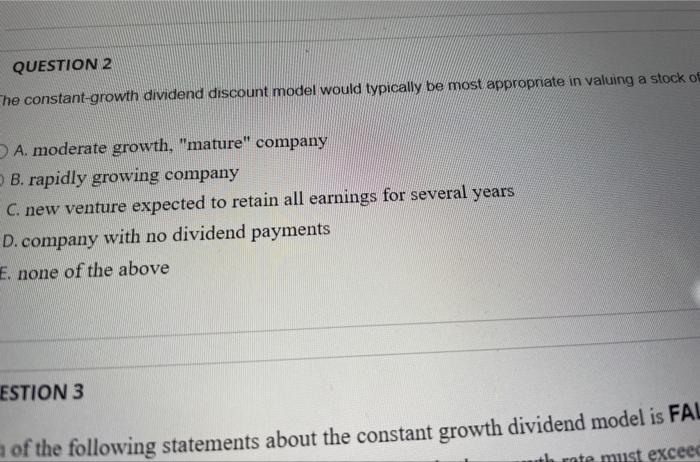

Question: QUESTION 2 The constant-growth dividend discount model would typically be most appropriate in valuing a stock of A. moderate growth, mature company B. rapidly growing

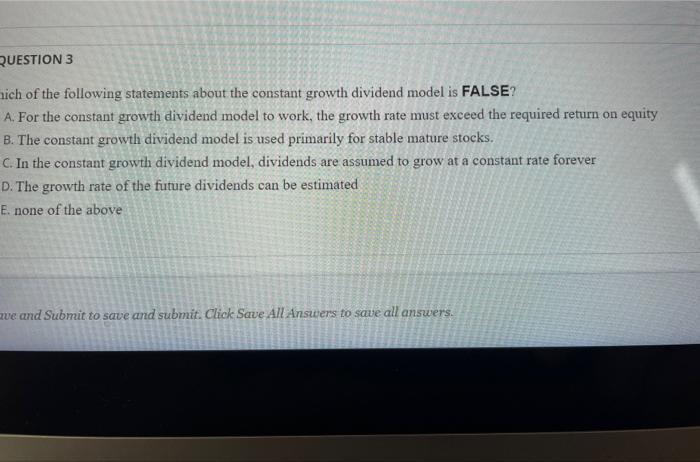

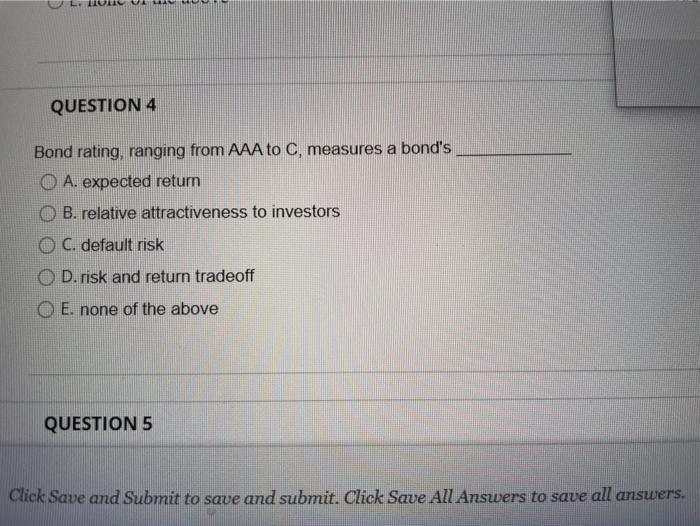

QUESTION 2 The constant-growth dividend discount model would typically be most appropriate in valuing a stock of A. moderate growth, "mature" company B. rapidly growing company C new venture expected to retain all earnings for several years D.company with no dividend payments E. none of the above ESTION 3 of the following statements about the constant growth dividend model is FAL exceed QUESTION 3 hich of the following statements about the constant growth dividend model is FALSE? A. For the constant growth dividend model to work, the growth rate must exceed the required return on equity B. The constant growth dividend model is used primarily for stable mature stocks. C. In the constant growth dividend model, dividends are assumed to grow at a constant rate forever D. The growth rate of the future dividends can be estimated E. none of the above awe and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 4 Bond rating, ranging from AAA to C, measures a bond's O A. expected return O B. relative attractiveness to investors C. default risk OD. risk and return tradeoff O E. none of the above QUESTION 5 Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts